Turaths & Todays: Muamalat Essentials

(Class #2, Summary of the class)

Haqq (حقّ) – Rights

Three Types of Rights in Islam

In Islam, there are three primary categories of rights: the Rights of Allah, the Rights of Human Beings, and a Combination of Both. As Muslims, we strive to be the best servants of Allah (SWT) by fulfilling the rights outlined in Islamic teachings.

1. The Rights of Allah (Haqq Allah)

These are rights that are directly related to Allah’s commands and prohibitions, aiming to draw a servant closer to Him (taqarrub) and to uphold the symbols and rituals of Islam.

- Objective: To attain closeness to Allah SWT and to uphold Islamic rituals and symbols.

- Implementation: Fulfilling obligations and avoiding prohibitions as instructed in the Qur’an and Sunnah.

- Examples:

- Performing the five daily prayers

- Fasting during the month of Ramadan

- Paying zakat (obligatory charity)

- Abstaining from alcohol and adultery

2. The Rights of Human Beings (Haqq Al-Insan)

These are rights that concern the well-being and welfare of individuals, whether in general or specific matters.

- Objective: To protect the interests and well-being of individuals within society.

- Examples:

- Fulfilling responsibilities toward dependents or family members

- Honouring contracts and agreements, such as ensuring fair transactions in trade

3. Combined Rights of Allah and Human Beings

This category includes matters that involve both divine rights and human rights.

Example: The waiting period (‘iddah) after divorce.

- Right of Allah: The woman is required to observe the ‘iddah according to Islamic law, depending on her specific circumstances.

- Right of Humans: It serves to protect both the former husband and wife, ensuring that the rights of any potential offspring (such as their lineage) are safeguarded.

As illustrated in the hadith narrated by Mu‘adh ibn Jabal رضي الله عنه:

عَنْ مُعَاذِ بْنِ جَبَل رَضِيَ اللهُ عَنْهُ قَالَ: كُنْتُ رِدْفَ النَّبِيِّ ﷺ فَقَالَ: يَا مُعَاذُ، هَلْ تَدْرِي حَقُّ اللهِ عَلَى عِبَادِهِ؟ وَمَا حَقُّ العِبَادِ عَلَى اللهِ؟ قُلْتُ: اللهُ وَرَسُولُهُ أَعْلَمْ، قَالَ: “فَإِنَّ حَقَّ اللهِ عَلَى العِبَادِ أَنْ يَعْبُدُوهُ وَلَا يُشْرِكُوا بِهِ شَيْئًا، وَحَقُّ العِبَادِ عَلَى اللهِ أَنْ لَا يُعَذِّبَ مَنْ لَا يُشْرِكُ بِهِ شَيْئًا، فَقُلْتُ يَا رَسُولَ اللهِ أَفَلَا أُبَشِّرُ النَّاسَ؟ قَالَ: “لَا تُبَشِّرْهُمْ فَيَتَّكِلُوْا”. (رواه بخاري ومسلم)

“The right of Allah upon His servants is that they worship Him and do not associate anything with Him. And the right of the servants upon Allah is that He will not punish those who do not associate anything with Him.” Mu‘adh said, “O Messenger of Allah, shall I not inform the people of this?” The Prophet ﷺ replied, “Do not inform them, lest they rely on it (and neglect their duties).” (Narrated by Bukhari and Muslim).[1]

This hadith demonstrates the integration of both rights:

- Worshipping Allah with sincerity and without shirk is a clear right of Allah.

- In response, Allah grants His servants the right not to be punished, so long as they uphold that pure worship.

It reflects the mercy of Allah and also the responsibility upon believers to remain earnest and cautious in fulfilling their duties.

Maal (المال) – Wealth

- Fiqh Terminology: Imam Shafi’i definition: “What has value with which it is exchangeable; and the destructor of it would be made liable to pay compensation; and what the people would not usually throw away or disown, such as money, and the likes.”[2]

- This definition is held by the majority view, which encompasses benefits (manfa’ah), rights (huquq), material assets, and non-material assets.

- In Islam, it is important to know wealth is under whose ضامن (guarantee). The implications of a defect or harm caused, for example, can be determined accurately so that the correct compensation can be awarded to the rightful party.

There was a question: Are Cryptocurrencies and NFTs considered Maal?

- It can be considered a digital asset (Maal) as it has value and utility. The exchanges of bitcoin and NFTs between two parties are registered in the blockchain.

- On the other hand, according to Egypt’s Dar Al-Ifta[3], bitcoin transactions like cryptocurrencies and NFTs as part of blockchain technology are considered haram for several reasons, including:

- Bitcoin is considered akin to counterfeit currency due to the lack of clear terms and conditions governing its exchange for legitimate and tradable currency. Its ambiguous nature contains elements of fraud and uncertainty, which can lead to confusion and potential financial loss for users.

- Contains gharar and maysir: These transactions create significant risks as the price of bitcoin is highly unpredictable, and the potential losses incurred can be substantial. The high risks associated with such practices are strictly prohibited in Islam, aligning with the general principle outlined by Imam Muslim in his book (Sahih Muslim). As narrated by Abu Hurairah, the Prophet Muhammad (ﷺ) stated, “Whoever deceives us is not one of us.”

- Potentially to open the door to illegal activities: The difficulty in monitoring Bitcoin makes the system vulnerable to illicit activities prohibited by Sharia, such as arms and drug trafficking, which could harm society.

The Categories of Maal

- المال المتقوم (Valuable Wealth): This refers to wealth that has already been acquired and is permissible to use according to Syariah. Examples include properties, food, and other assets that are legally owned and usable.

- المال غير المتقوم (Non-valuable Wealth): This refers to things that have not been acquired or cannot be utilised. Examples include fish in the sea, birds in the air, alcoholic beverages, and non-halal food items.

Wealth based on mobility:

- Fixed wealth: Assets that are immovable, such as buildings.

- Movable wealth: Assets that can be transferred or moved, such as phones or vehicles.

Perishable vs. Non-perishable Goods:

- Perishable goods: Items that have expiry dates and can spoil, such as food.

- Non-perishable goods: Items that can be preserved for a long time without spoiling, such as diamonds and gold.

- المال المثلي (Homogeneous Wealth): Wealth that is non-specific and has identical counterparts in the market with no difference in parts or quality. These items are measurable by weight or count. Examples include wheat, sugar, and cotton. These goods are traded based on standardised measures (e.g., 1 kg of wheat equals 1 kg of grain).

- المال القيمي (Heterogeneous Wealth): Wealth that is specific or unique, without exact equivalents in the market, or if similar, differs in value. Examples include specific animals or particular properties. These items are measured according to their value rather than quantity.

Maqasid Shariah (مقاصد الشريعة)

Definition

Maqasid Shariah refers to the higher objectives or goals of Islamic law, aiming to ensure human welfare and prevent harm.

Purpose

The primary purpose is to preserve and protect essential aspects of life and society.

Five Essential Objectives (Al-Kulliyat Al-Khams):

- Protection of Religion (Hifz al-Din): Safeguarding faith and religious practices.

- Protection of Life (Hifz al-Nafs): Ensuring safety and preservation of human life.

- Protection of Intellect (Hifz al-‘Aql): Protecting the mind from harm and promoting knowledge.

- Protection of Lineage (Hifz al-Nasl): Preserving family and societal continuity.

- Protection of Property (Hifz al-Maal): Securing wealth and economic stability.

Importance: Maqasid Shariah guides the application and interpretation of Islamic law to align with justice, mercy, and public interest.

Contemporary Relevance: It facilitates the adaptation of Islamic principles to modern challenges, striking a balance between tradition and current societal needs.

There was a question: Is Forex (foreign exchange) permissible? Institutional vs Retail

- Currencies categorised as a form of ribawi wealth follow the rules of gold and silver trading.

- In Islam, Forex is allowed; we must ensure that it is the same amount for each currency, done on the spot and subjected to mutual agreement between two parties.

- Forex is permissible when it is done on the spot, and the foreign currency bought can be physically transferred to the user or deposited into their account.

- Ulama’ have permitted deferred delivery as well if the transfer of the item requires time, depending on the prevailing custom (‘urf).

- In institutional settings, such as banks, these requirements are typically met.

- However, for retail options, virtual platform transactions may be fictitious (not real). Users would typically have to convert the foreign currency they purchased into their currency to withdraw the gains. They do not physically own the exchanged currency or in their accounts, making it impermissible.

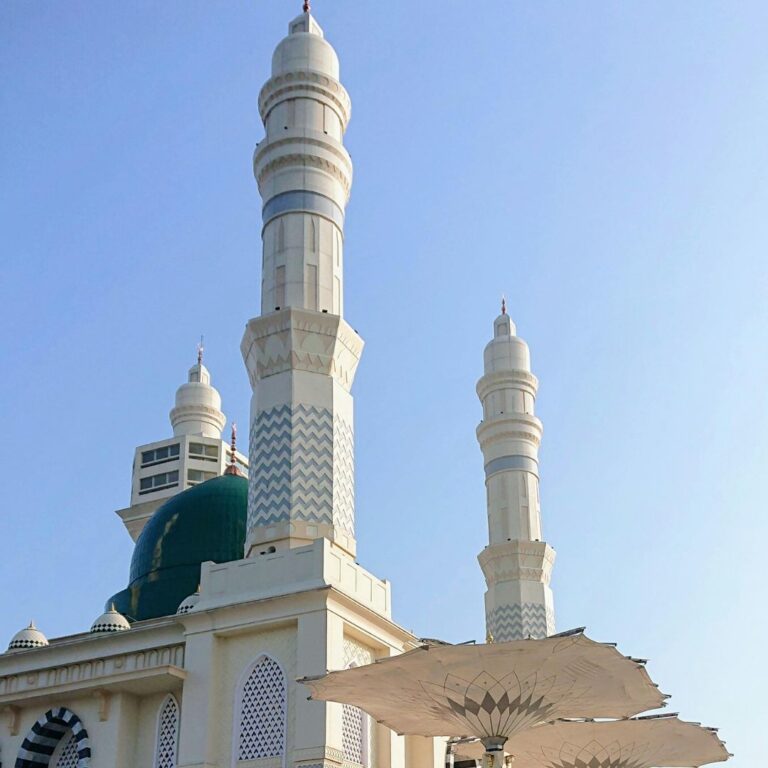

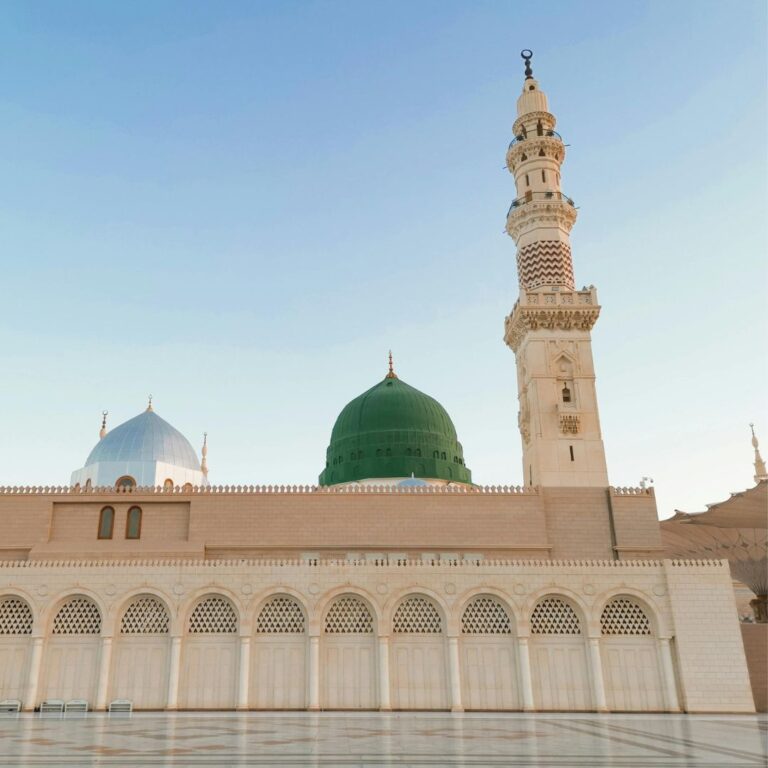

On this occasion, we would like to discuss a book titled: Al-Yaqut An-Nafis fii Madzhab ibn Idris (A precious stone in the Madzhab of ibn Idris, or what we know as Imam Shafi’i):

- Imam Shafi’i’s full name is Abu ʿAbdillah Muhammad bin Idris Ash-Shafi’i.

- Imam Shafi’i’s lineage goes all the way to Rasulullah’s (ﷺ) great-grandfather.

- It is a Matan (classical text) that is concise in its explanation.

- The author of the book is Al-Imam Ahmad bin Salim As-Shatiri (d. 1312-1360 H). Given isyarah (instruction) to write the book by his teacher.

- The book compiles the takrifs (terminologies) to explain the topics, encompasses the pillars and conditions of those topics, and provides examples for each of these topics.

- The book aims to aid students of knowledge and teachers by providing a concise overview of the subject.

Muqaddimah (المقدمة) – Introduction

Question: What must a student of knowledge know before they learn a specific topic?

10 Basic principles for students (in studying Fiqh):

- The Definition (Al-Hadd) of the subject: A science related to Islamic Shariah rulings that are practical, and its rulings are derived from detailed evidence.

- The subject matter: The actions and conduct of those who are legally accountable (Mukallaf) in Islam.

- The benefits of studying it: To obey all the commands of Allah SWT and avoid all His prohibitions.

- The issues covered: Topics such as worship (Ibadah), transactions (Muamalah), marriage and family law (Munakahat), criminal law (Jinayat), and others. However, the primary focus here will be on Muamalah (transactions).

- The name of the discipline: Fiqh (Islamic Jurisprudence).

- The sources of the knowledge: The Qur’an, the Sunnah, consensus (Ijma’), and analogical reasoning (Qiyas).

- The ruling (Hukm) on learning it: The ruling varies:

- Fard ‘Ayn (Individual Obligation): For knowledge necessary in daily life (e.g., Ibadah, Muamalah, Munakahat).

- Fard Kifayah (Communal Obligation): Obligatory on some; if no one learns it, the whole community bears the sin.

- Sunnah (Recommended): For knowledge that is unique or supplementary in nature.

- Its position among other Islamic sciences: it is a distinct discipline with its own subject matter and methodology, different from other fields of Islamic knowledge.

- Its importance: It holds a high rank among the Islamic sciences due to its direct application in daily life and worship.

- The Authors of the discipline: The founding jurists (Mujtahid Imams) such as Imam Abu Hanifah, Imam Malik, Imam Ash-Shafi‘i, and Imam Ahmad ibn Hanbal, and other Imams Al-Mujtahidin.

Ba’i (البيع)

Ba’i linguistically refers to: Exchange of an article for an article, such as item for item.

Trade in the domain meaning of the divine legislation or its understanding thereof (usually mentioned as syara’ for convenience and brevity) is: A contract of wealth exchange that gives the benefit of owning the asset or owning the right to utility in perpetuity (Opinion of Jumhur (majority) of the ulama’ in the Shafi’i, Maliki and Hanbali madzhab).

- For example, leasing is considered a form of Ba’i. When renting a house, you purchase the rights to the utilities of the house, but not ownership of the house itself (an actual asset).

For the Hanafi madzhab, leasing is not considered Ba’i but is viewed as an ijarah (leasing).

- For example, a farmer owns a tractor and decides to lease it to another farmer for three months at a rate of 500 rupees per month. In this agreement, the ownership of the tractor remains with the owner, while the lessee only has the right to use the tractor during the lease period. The lessee can pay the full rent of 1,500 rupees upfront or pay 500 rupees each month. After the three months are over, the tractor must be returned to the owner unless both parties agree to extend the lease.

Contracts in Islam

There are several types of contracts (ʿaqd) in Islam:

- Contract of exchange (عقد معاوضات): These are contracts that involve the reciprocal exchange of goods or value.

Examples:

- Ba’i (Sale and purchase): Includes Musawamah (bargaining sale), Murabahah (cost-plus sale), Salam (advance payment for future delivery), and Istisna‘ (manufacture contract).

- Ijarah (Leasing/Renting): Renting of services or assets.

- Shirkah (Partnership): A business or financial arrangement where two or more parties contribute capital, labour, or expertise and share the profits and losses based on agreed ratios.

- Wakalah Bil ujroh (agency)

- Sharf (Currency Exchange): Exchange of currencies or gold/silver.

- Voluntary contract (عقد تبرعات): Contracts that are not profit-oriented, but rather intended for goodwill and charity.

Examples:

- Hibah (Gift): Voluntary transfer of ownership without expecting return.

- Waqf (Endowment): Donating property for religious or charitable purposes.

- Wasiyat (Bequest): a legal declaration made by a person about the distribution of a portion of their wealth.

- Supplementary contracts:

- Rahn (رهن) or Pawnbroking: pawning an item in trust, such as gold, as collateral or security. The item will be liquidated if the terms in the contract are not fulfilled.

- And many other contracts.

Note: Understanding the phrase “على التأبيد“ in the context of Bai’ (sale), it means that the requirement of Bai’ is the permanent transfer of ownership, not for a limited or specified period.

For example, if I sell you this book for one month for $50, it is not considered a sale (bai’), but rather a lease (ijarah), because the ownership is not transferred permanently.

Pillars of Sale Transactions:

- The buyer and the seller

- The traded article, the price and the article priced

- The contract procedure, which must consist of an offer (ijab) and acceptance (qabul)

Ijab and Qabul in Different Madzhabs

Shafi‘i Madzhab (Classical View): In the Shafi‘i school of thought, classically:

- The ijab (offer) must come from the seller, and the

- Qabul (acceptance) must come from the buyer.

- Both offer and acceptance must be expressed verbally and clearly between the two parties.

Example:

- Seller: “I sell you this item.”

- Buyer: “I buy it from you.”

However, this formal verbal exchange is not widely practised today, especially in modern commercial contexts.

In other Madzhab, particularly Hanafi:

- There is no strict requirement for the offer to come specifically from the seller or the buyer.

- Either party can initiate the offer, and it may be accepted by the other.

- A sale is considered valid as long as there is:

- Tawafuq (توافق) – mutual agreement

- Taradhi (تراضي) – mutual consent between both parties

This flexible understanding aligns with modern practices, such as:

- Contactless payments (e.g., PayWave)

- Online transactions (e.g., purchases through Shopee or other e-commerce platforms)

Requirements for the buyer and seller (4):

- Legal Capacity to Conduct the Transaction

- The seller must own the item.

- Both parties must be of sound mind and have reached the age of maturity.

- For children who are Mumayyiz (discerning age but not yet mature), parental or guardian consent is required for the transaction to be valid.

- Free Will

- The transaction must be conducted voluntarily, without coercion or force.

- Religious Eligibility (Where Applicable)

- For certain transactions, such as purchasing religious items like a Quran, the buyer must be a Muslim.

- Absence of Harm or Hostility

- The transaction should not be linked to potential harm to others.

- Example: Investing in stocks such as Palantir, which provides AI services to intelligence agencies (e.g., USA and Israel), may be Shariah-compliant in structure. However, ethical concerns arise due to the potential harm to Palestine or other parties that may result from the services they offer.

Clarification on sale and rent

A sale (bai’) in its original form refers to the permanent transfer of ownership.

When we rent a house, it means we purchase the (Manfaah) or benefit from the house, which is a form of Manfaah that can still be traded, similar to a Mall.

- When a time limitation is involved, it becomes a Bai’ Al-Manfaah (sale of benefit) or Ijarah (lease), both of which are subcategories of sale agreements (part of Ba’i).

- Examples:

- Renting a house or borrowing a book for a specific time period both fall under ijarah.

- In Singapore, buying a leasehold property (e.g., HDB flat) is considered Bai’ Al-Manfaah, as ownership is granted for a limited utility period.

Zakat on Purchased Assets (e.g., Shares)

- The zakat obligation depends on the intention:

- If the shares are bought for trading, zakat is payable on the full market value.

- If they are purchased for long-term holding, zakat is only due on the Zakatable portion (e.g., cash, inventory) of the company’s assets.

- MUIS Fatwa (Singapore):

- Pay 2.5% of the asset’s market value.

- Other Views (e.g., Maybank Islamic, OIC Fiqh Academy):

- Pay 2.5% on the Zakatable portion of the company’s current assets, not the total share value.

[1] Muslim, Ibn al-Hajjaj. Sahih Muslim, Hadith no. 30.

[2] Al-Imam As-Suyuti, Al-Ashbaah wan Nadzaair.

[3] http://www.dar-alifta.org/ar/fatwa/details/14139/حكم-تداول-عملة-البيتكوين-والتعامل-بها