Your Guide to Islamic Financing in Singapore

Introduction to Islamic Finance in Singapore

1. What is “Shariah-compliant”?

In finance, the term “Shariah-compliant” refers to products or services that adhere to ethical rules derived from Islamic principles. A simple way to understand this is by thinking about Halal in food. Just as Halal labels indicate that food is prepared in a specific manner, Shariah compliance signals that a financial product adheres to certain standards.

These standards include avoiding interest-based activities (riba), excessive ambiguity (gharar), and gambling-like practices (maysir). They also rule out investments in businesses connected to harmful industries such as alcohol, tobacco, or weapons.

For businesses and financial institutions, being Shariah-compliant is not only about restrictions. It is also about promoting responsible practices, encouraging investments that benefit society, and operating with fairness and transparency.

Importantly, while these principles are rooted in Islam, the values they uphold—such as ethical conduct, transparency, and avoiding harmful industries—are universal. This is why Shariah-compliant finance and wealth management are increasingly seen as an option for anyone seeking ethical and responsible financial choices, regardless of faith.

1.2. Key Features of Islamic Financing

At first glance, Islamic financing may appear similar to conventional financing, as both aim to help individuals and businesses acquire goods, services, or assets. The primary difference lies in the structure of the transactions.

In conventional finance, a loan is typically interest-based—the borrower pays interest to the lender for using the money. In Islamic finance, charging or paying interest (riba) is not allowed. Instead, financing is structured through Shariah-compliant contracts that change the nature of the relationship.

One example is Murabahah, a cost-plus sale. Here, the bank buys an asset or commodity first, then sells it to the customer at a marked-up price, which is paid in instalments. Another example is Musharakah or Mudharabah, where the bank and the customer enter into a partnership, sharing profits (and, importantly, risks) based on agreed-upon terms.

These contracts are designed to ensure that risk is shared equitably between both parties, rather than transferred entirely to the customer or the bank. Another key principle is that all transactions must have an underlying asset, whether tangible or intangible, so that financial activity is always connected to genuine economic value.

Table 1 below provides a brief comparison that highlights the differences between conventional and Islamic financing models.

| Conventional Banking | Islamic Banking |

| The business model is based on lending and borrowing money with interest. | Uses Shariah contracts that avoid interest (riba), excessive ambiguity (gharar), and gambling-like activities (maysir). |

| Practices like short selling, the sale of debts, and speculation are standard. | Avoid interest-based lending and speculative activities to ensure transactions are fair and transparent. |

| May finance almost any industry, unless restricted by local law or ESG filters. | Does not finance industries considered harmful, such as alcohol, tobacco, or gambling. Applies dual screening for both sustainability and ethical principles. |

| Treats money as a commodity, lending it for interest. | Promotes real economic activity through asset-backed/based financing, leasing, or profit-and-loss sharing. |

| The relationship with the customer is typically that of a creditor and debtor. | Relationship depends on the contract type, such as buyer–seller (Murabahah) or partners (Musharakah, Mudharabah). |

| Compensation is mainly interest margin. | Compensation is profit or rental income, depending on the contract. Interest (riba) is strictly prohibited. |

Table 1. Comparison of Conventional and Islamic Banks (Adapted from United Bank Limited (UBL), 2024)

1.3. Relevance of Islamic Finance in Singapore

Singapore has long positioned itself as a leading global financial centre. In recent years, there has been growing interest in incorporating Islamic finance into this ecosystem. At Maybank’s Invest ASEAN 2023 Conference, industry leaders highlighted that Singapore is “well-poised to become a global hub for offshore Islamic wealth within the next five years” as demand for Islamic finance products continues to rise (Leng, 2023).

The government has also recognised the role Islamic finance can play in keeping Singapore competitive as an international fund management hub. While some neighbouring countries may have moved more quickly in this space, Singapore’s strong financial infrastructure means there is still significant room for growth (Khan and Bashar, 2008)..

For Muslims in Singapore, this development provides greater access to Shariah-compliant financial and wealth management options that align with their values. For non-Muslims, it offers alternative products that emphasise transparency, socially responsible investing, and long-term stability, all of which are features that increasingly appeal to a broader audience.

2. Types of Shariah-compliant Financing Available in Singapore

Several established financial institutions in Singapore, including Maybank, CIMB, and ValueMax, offer Islamic financial products alongside their conventional services. While the range of products is still smaller compared to other markets, it is gradually expanding as interest grows.

These offerings are made available through dedicated businesses focused on providing Shariah-compliant alternatives or via Islamic banking windows, which are specialised divisions within conventional banks that offer Shariah-compliant options to customers who prefer them.

The next section highlights the main types of Shariah-compliant financing currently available in Singapore, providing an overview of how each product works and what distinguishes it from conventional options.

2.2. Ar-Rahnu: An Alternative to Conventional Personal Financing

Personal loans are a common way for people in Singapore to finance big-ticket expenses such as home renovations, weddings, or debt consolidation. Conventional banks, such as OCBC, UOB, and DBS, typically offer these loans with annual interest rates starting from around 2.88% (depending on the prevailing interest rate environment). While convenient, the interest element makes them unsuitable for Islamic finance.

As an alternative, Islamic finance offers Ar-Rahnu, also known as Islamic pawnbroking. This is a form of short-term, collateralised financing that avoids interest-based dealings

Here’s how it works:

- You pledge a valuable asset, usually gold, as collateral.

- The bank or provider gives you a cash loan equivalent to a portion of the item’s value.

- You only repay the principal amount, not interest.

- The provider may charge a small safekeeping fee (Al-Ujrah) to cover the storage and security of the pledged item.

If repayment is not made, the gold can be sold to recover the loan amount; any surplus after deducting the outstanding sum is then returned to the borrower. This ensures transparency and fairness.

In Singapore, Ar-Rahnu Singapore and Public Gold Marketing Pte. Ltd. are among the institutions currently offering this Shariah-compliant service. While designed with Muslim customers in mind, Ar-Rahnu is also attractive to anyone seeking short-term financing that is transparent, asset-backed, and free from compounding interest.

2.2.1. Ar-Rahnu Singapore

Ar-Rahnu Singapore Pte. Ltd. has partnered with ValueMax Pawnshop, a well-known listed company, to open Singapore’s first Shariah-compliant pawnbroking branch at Joo Chiat Complex. It has since expanded with a second outlet on Haig Road.

Through these branches, customers can access a range of services, including Islamic pawnbroking, investment-related transactions, and Shariah-compliant financing. This makes Ar-Rahnu Singapore one of the key providers of interest-free pawnbroking services in the country, offering the community an alternative for short-term financing.

2.2.2. Public Gold Marketing Pte. Ltd

Public Gold Marketing Pte. Ltd. is the Singapore arm of Malaysia’s Public Gold Marketing Sdn. Bhd., a well-established name in gold trading. The company is involved in activities such as minting and refining gold, managing gold trading centres, and providing secure storage facilities for customers.

In Singapore, Public Gold offers a variety of Shariah-compliant products, including gold bullion, gold dinar wafers, silver bullion, and dirham wafers. These items are not only investment-grade precious metals but also recognised as a viable savings instrument for customers.

Public Gold also offers Islamic pawnbroking services, allowing customers to pledge gold as collateral for short-term financing. Typically, the pawn value offered is between 60% and 80% of the item’s market price, and a small safekeeping fee is charged for storage and security of the pledged gold.

Together with Ar-Rahnu Singapore, Public Gold is one of the two leading providers of Shariah-compliant pawnbroking in Singapore. A comparison of their services is shown in the table below.

| Ar-Rahnu in SG | Public Gold Marketing Pte. Ltd | ValueMax Pawnshop |

| Pawn value offered | About 60% of market value | Up to 100% of market value |

| Safekeeping fee | 1.0% per month | 1.0% per month (if pay every month)

1.5% per month (if 1 payment missed) |

| Fee type | Simple (non-compounded) | Simple (non-compounded) |

| Shariah Advisor | Public Gold Marketing Sdn. Bhd. is advised by the Syariah Panel of Amanie Advisors Sdn Bhd. | Ustaz Kamal Mokhtar |

Table 2: Summary of Ar-Rahnu providers in Singapore (Source: ValueMax Singapore, Public Gold Marketing Singapore)

2.3. Business Financing for small and medium-sized enterprises

In Singapore, many small and medium-sized enterprises (SMEs) rely on business loans to manage their cash flow, purchase equipment, or fund expansion. Conventional business loans usually involve borrowing a fixed sum and repaying it with interest.

Shariah-compliant business financing offers an alternative approach. Instead of charging interest, these facilities are structured around profit-sharing or trade-based contracts. For example, a bank may purchase equipment and sell it to the business at an agreed markup, or enter into a partnership where profits and risks are shared.

The benefit for SMEs is that they still gain access to working capital, but in a way that is transparent, asset-backed, and aligns with their values. This model not only appeals to Muslim business owners but can also be attractive to non-Muslim entrepreneurs who value fairness in risk-sharing and a closer partnership with their financier.

2.3.1. Maybank Singapore

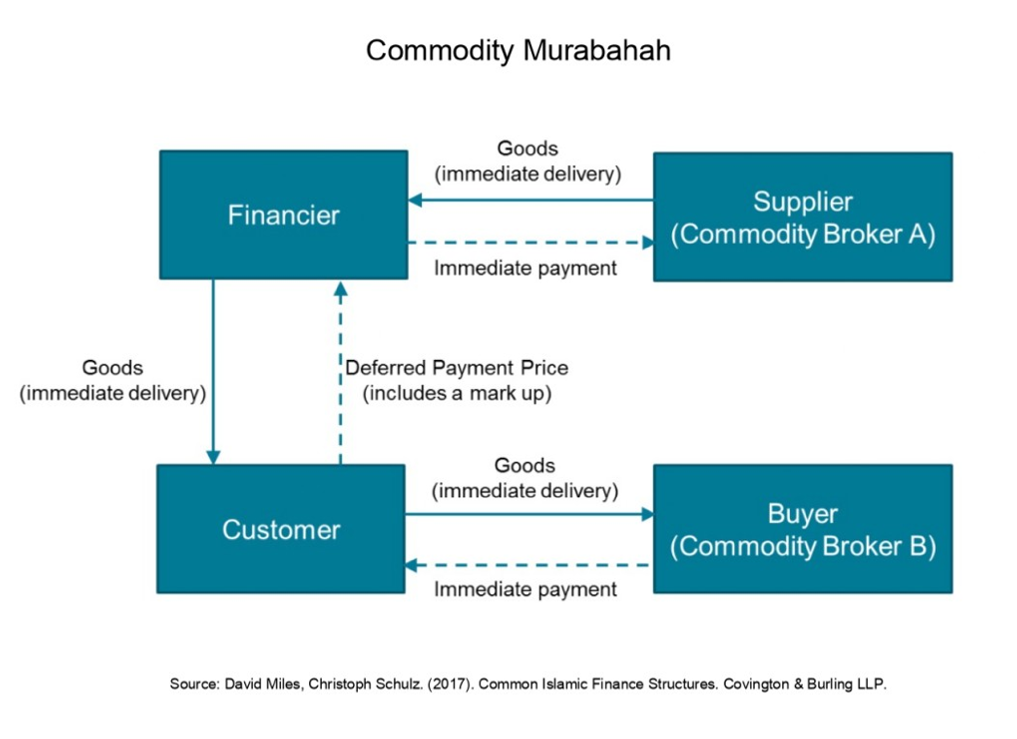

Maybank Singapore was the first bank in the country to introduce Shariah-compliant term financing for corporates. One example is its Commercial & Industrial Property Financing-i, which is structured using a common Islamic contract called Commodity Murabahah.

Here’s how it works in simple terms:

- The bank buys a commodity (such as palm oil or metal) from a commodity market.

- It then sells the commodity to the business at a marked-up price, with payment spread out over an agreed period.

- The business immediately sells the commodity to a third-party trader to obtain cash for its own use.

This process enables businesses to obtain financing without incurring interest. Instead, they pay a clearly agreed profit rate, which can be fixed or floating.

For companies, this structure provides liquidity in a transparent and Shariah-compliant way, while ensuring real assets back all transactions. It is designed not only for Muslim-owned businesses but also for any company that values asset-based financing as part of its growth strategy.

Figure 1: Commodity Murabahah Modus Operandi (Source: Islamic Finance News, 2022)

Figure 1: Commodity Murabahah Modus Operandi (Source: Islamic Finance News, 2022)

2.3.1.1. Commercial and Industrial Property Financing-i

The bank has offered several Islamic financial solutions that adhere to Shariah principles. Firstly, the Maybank Commercial and Industrial Property Financing-i offers benefits such as floating-rate term financing with ceiling protection against market volatility, tenures ranging from 5 years to 30 years, a financing margin of up to 80% of the purchase or valuation price (whichever is lower), and subsidies for legal and valuation fees.

This facility enables businesses to finance the purchase of commercial and industrial properties in accordance with Shariah principles. Key features include:

- Financing type: Floating-rate term financing with ceiling protection to guard against market volatility

- Tenure: 5 to 30 years

- Financing margin: Up to 80% of the purchase price or valuation (whichever is lower)

- Additional benefits: Subsidies for legal and valuation fees

This product is especially useful for businesses seeking to purchase property for expansion while maintaining Shariah-compliant financing.

2.3.1.2. Business Term Financing-i

This product provides working capital for SMEs without requiring collateral. Key features include:

- Financing quantum: Up to SGD 500,000

- Tenure: Up to 5 years

- Packages: Flexible financing packages with competitive profit rates

- No collateral required

This provides SMEs with access to short- to medium-term funds in an ethical, transparent, and asset-based manner.

2.3.2. CIMB Singapore

CIMB is another leading bank in Singapore offering Shariah-compliant solutions for businesses. As part of the CIMB Group’s regional Islamic banking network, it offers products and services that adhere to Islamic principles while catering to the needs of modern businesses.

For SMEs in Singapore, CIMB offers four types of Shariah-compliant financing options, all structured under the widely used Commodity Murabahah model. These provide business owners with an alternative to conventional loans, enabling them to access working capital or fund growth in a transparent and interest-free manner.

Beyond SME financing, CIMB’s Islamic banking services also cover areas such as sukuk issuance, investment banking, and takaful, serving both corporate and institutional clients across ASEAN.

The next section will outline the four key SME financing options available from CIMB Singapore.

2.3.2.1. Revolving Credit Facility-i

This facility is designed to help businesses manage short-term cash flow needs more flexibly. Instead of taking one large lump-sum loan, companies can draw down funds from an approved limit whenever they need it—much like having a credit line.

Key features include:

- Financing amount tailored to the business’s needs and collateral value

- Funds can be used and repaid multiple times within the facility limit

- Option to provide security (collateral) or apply on an unsecured basis

- Supports working capital needs such as payroll, inventory, or supplier payments

This structure enables SMEs to access financing on demand, providing them with greater control over their cash flow while remaining compliant with Shariah principles.

2.3.2.2. Term Financing-i

Term Financing-i is a Shariah-compliant facility that enables businesses to fund large purchases or projects using their assets as collateral. It can be used in several ways:

- Asset acquisition or refinancing: Finance the purchase of new assets, or refinance existing ones to free up cash.

- Bridging finance: Provide short-term funding while waiting for longer-term financing to be arranged, or until proceeds from a property sale are received.

- Project financing: Support major projects in areas such as real estate development, power, energy, or mining.

- Private equity financing: Offers funding to private equity funds, secured against the fund’s committed but not yet drawn capital.

This facility allows businesses to access larger pools of financing in a transparent, Shariah-compliant manner, while keeping funding tied to real assets and projects.

2.3.2.3. Vessel Financing

Although not as common, this option allows businesses to purchase vessels as assets and incur capital expenditure to maintain their existing assets. It can be used to:

- Purchase new vessels as business assets

- Fund the maintenance and upgrading of existing vessels

- Invest in additional capacity to support growth and improve efficiency

While this type of financing is more niche, it offers companies in maritime-related industries an asset-backed means to expand their operations.

2.3.2.4. Property Financing

This form of financing allows businesses to purchase or refinance property. It offers flexibility with a choice of fixed or variable profit rates, with ceiling protection to safeguard against sudden spikes in market rates.

Key benefits include:

- Funding for property purchases or refinancing existing properties

- Flexibility to choose fixed or variable profit rates, with protection against market volatility

- Ability to free up capital tied to property, so funds can be redirected into business expansion or upgrading existing assets

This facility enables SMEs and corporates to manage property-related investments efficiently while keeping financing linked to real assets.

2.3.3. Kapital Boost

Beyond banks, SMEs in Singapore can also access Shariah-compliant financing through Kapital Boost, an Islamic peer-to-peer (P2P) crowdfunding platform. It connects global investors with local businesses, offering short-term, ethical financing opportunities.

For SMEs, Kapital Boost helps overcome financing constraints by providing quick access to working capital. For investors, it opens up opportunities to support promising ventures with a minimum investment of SGD 2,000.

How it works:

Like conventional crowdfunding, Kapital Boost raises small amounts of money from many investors. The funds are then channelled into businesses using Shariah-compliant structures:

- Based on Qard (benevolent loan) and Wakalah(agency).

- Investors advance cash to SMEs against unpaid invoices.

- Investors are appointed as agents to collect the invoice once it is paid by the SME’s customer.

- Investors pool funds to buy assets such as inventory or raw materials.

- These assets are sold to the SME at a pre-agreed markup.

- The SME pays back the cost-plus markup at a later date, usually backed by an existing purchase order.

This model allows SMEs to access funds without interest-based borrowing, while investors benefit from transparent, asset-backed returns.

Figure 2: Kapital Boost Invoice Financing (Source: Kapital Boost website, invoice financing)

Figure 3: Kapital Boost Asset Purchase Financing (Source: Kapital Boost website, asset purchase financing)

However, businesses can also opt for Ar-Rahnu as an alternative to crowdfunding options or borrowing from banks, if they are able to meet the requirements of a collateralised loan as mentioned in the previous section. This is because the process is much smoother, where the business owner can acquire immediate access to funds once the collateral is pledged. This is useful for urgent financial needs.

The table below provides a summary of the different forms of business financing:

| Business Financing in Singapore | Ar-Rahnu | Crowdfunding | Banks |

| Usually for |

|

SME | SME |

| Process | Instant | New and repeated | Case-by-case basis |

| Financing rate | Safekeeping fee | Expected profit rate | Profit rate (fixed or floating) |

| Based on the structure |

|

Mudarabah

Musharakah Murabahah |

Murabahah

Ijarah Tawarruq (Commodity Murabahah) |

Table 3: Summary of Shariah-compliant business financing in Singapore (* doesn’t include grants and angel investing, ** Source: Author’s own )

2.4. Auto Financing For Retail Consumers

Buying a car is one of the bigger financial commitments for many households in Singapore. Auto financing makes this easier by allowing buyers to pay for their car in instalments rather than in one lump sum.

Maybank offers a Shariah-compliant version called Auto Finance-i. With this facility, customers can finance up to 70% of the purchase or valuation price of a vehicle (whichever is lower), with a repayment period of up to 7 years.

Auto Finance-i is structured using the Islamic concept of Ijarah Thumma Al-Bai (AITAB), also known as a hire purchase arrangement. Here’s how it works:

- The bank purchases the vehicle and leases it to the customer.

- The customer makes fixed monthly rental payments at an agreed profit rate, so there are no surprises from fluctuating interest rates.

- At the end of the payment term, ownership of the car is transferred to the customer.

Applications are open to Singapore citizens, permanent residents, and foreigners with employment passes (with a local guarantor), provided the applicant has a minimum monthly income of SGD 1,500. Payments can be conveniently made via GIRO.

This arrangement ensures transparent, predictable repayments without interest charges, making it an attractive option for consumers seeking an alternative financing option.

2.5. Education loan

One of the most meaningful applications of Islamic finance in Singapore is in education. Yayasan Mendaki offers interest-free study loans to help students pursue tertiary education or professional training without the burden of interest charges.

Who can apply:

- Students enrolled full-time or part-time in accredited local public or private institutions

- Full-time undergraduates at accredited overseas universities (case-by-case basis)

- Malay/Muslim workers upgrading their skills through recognised work-related courses (up to SGD 5,000 or 70% of course fees, whichever is lower)

How repayment works:

- Repayments start as low as SGD 50 per month

- Six months after course completion, instalments increase gradually, with an annual progressive increment of SGD 100

In addition to Mendaki’s study loans, students can also explore bursaries and scholarships offered by various Malay/Muslim Organisations (MMOs). A directory of such financial aid options can be found at Islamic Finance SG.

These initiatives reflect the values of Islamic finance—supporting education, empowering individuals, and easing financial strain—principles that resonate with the wider community

2.6. Mortgage financing

Currently, there are no Shariah-compliant mortgage products in Singapore. This is mainly due to the restriction of the Central Provident Fund (CPF) Act that is yet to accommodate Islamic financing structures such as Commodity Murabaha and Ijarah muntahiyah bittamleek to be used in property financing (Islamic Finance News, 2022). Since the majority of Singaporeans utilise their CPF funds for property purchases, these funds, which the CPF Act governs, must adhere to the guidelines set by this legislation.

Currently, there are no Shariah-compliant mortgage products available in Singapore. The primary reason lies in the rules of the Central Provident Fund (CPF), which most Singaporeans use to fund their homes. Under the CPF Act, funds can only be used in ways that involve an interest element. Since Islamic finance avoids interest, existing Shariah-compliant structures, such as Murabahah (deferred sale) or Ijarah muntahiyah bittamleek (lease-to-own), do not fit within CPF rules.

Section 21 of the CPF Act states that individuals may utilise their CPF funds for the purchase or acquisition of immovable property. It also entitles the CPF Board to place a charge or interest over the immovable property. The interest is charged to secure the supposed interest that a CPF account would have received if it had not been used for the financing of the property. For reference, the current Housing Development Board (HDB) mortgage loan rate (2.6%) is pegged at 0.1% above the prevailing CPF Ordinary Account (OA) rate (2.5%).This greatly lowers the risk for the CPF Board in securing repayment of payable interest on a CPF account (Islamic Finance News, 2022).

Due to the stipulations of Section 21, CPF funds cannot accommodate Islamic financing structures such as Commodity Murabaha and Ijarah muntahiyah bittamleek.

For example:

- In a Murabahah agreement, the bank sells the property at a marked-up price with instalments, but no interest is charged. Since CPF requires an “interest” equivalent, this model cannot be used. “The interest” equivalent is needed to act as a replacement for the 2.5% interest that an individual would have gained if it were not withdrawn from their CPF OA to purchase their property

- In an Ijarah structure, the bank leases the property to the buyer. CPF does not allow lease payments, only property purchases.

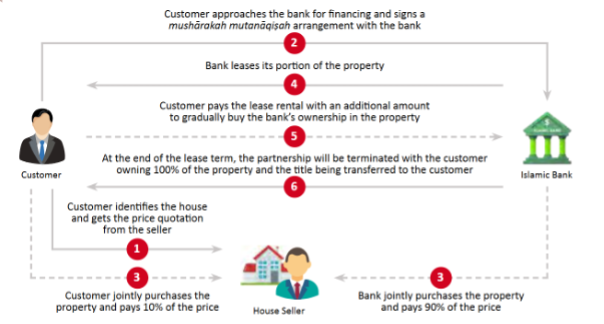

Possible Alternative: Musharakah Mutanaqisah

- The bank and the customer jointly purchase the property, with the bank typically covering a larger share (e.g., 90%).

- The customer gradually buys back the bank’s share over time while also paying rent on the portion still owned by the bank.

- As payments continue, the customer’s ownership increases, and the bank’s share decreases until full ownership is transferred.

Figure 4: Musharakah Mutanaqisah Modus Operandi

In the above instance, both the customer and the bank jointly purchase a property. For example, the customer may contribute 10% of the price while the bank provides the remaining 90%.

After purchase, the bank leases its share of the property to the customer, giving the customer full rights to use the home. The customer then makes regular payments made up of two parts:

- Lease rental: payment for using the bank’s share of the property (this amount decreases as the customer’s share grows).

- Equity buyout: a payment that gradually buys back the bank’s ownership.

Over time, the customer’s ownership increases, and the bank’s share declines, until the property is fully transferred to the customer at the end of the financing term.

To make this option viable, the lease payments in this agreement would need to be made in cash, rather than through an individual’s CPF account. Currently, there are conventional mortgage products in Singapore that utilise a combination of cash payments and CPF deductions to cover the monthly mortgage repayment. This suggests that the Musharakah Mutanaqisah model may be accepted in the future if more Muslims and various stakeholders, such as banks with Islamic Finance arms, advocate for this option.

The Road Ahead

For a Shariah-compliant mortgage to become a reality in Singapore, changes to legislation would likely be needed. Given that most Singaporeans live in HDB flats (77.4%) and many take HDB loans (53%), adjustments may be slow due to the structural reliance on CPF-linked financing. However, if more demand emerges from Muslim homeowners, and if banks with Islamic finance arms advocate for it, there could be momentum toward making Shariah-compliant home financing available.

2.7 Summary of Types of Islamic Financing

| Types of Islamic Financing | Explanation |

| Mudarabah (Profit and loss sharing partnership agreement) | An agreement where one partner (financier or rab-ul mal) provides the capital to another partner (labour provider or mudarib) who is responsible for the management and investment of the capital. The profits are shared between the parties according to a pre-agreed ratio. |

| Murabahah (Cost Plus Mark-up) | An agreement in which one party sells a commodity or asset it has purchased to a second party on specific terms, such as the cost price, the selling price, and the agreed-upon time period. The selling price comprises the cost of the asset and an agreed profit margin. |

| Musharakah (Profit-and-loss sharing joint venture) | An agreement where all partners contribute capital and share the profit based on an agreed-upon percentage and loss based on the proportion of capital contribution. In practice, there are two major types:

|

| Ijarah (Leasing) | An agreement where the bank (lessor) purchases an asset for lease upon a customer’s (lessee) request. The customer pays rent instalments for their lease period, which eventually results in the ownership of the asset. Ijarah can occur in financing contracts through IMBT (ijarah muntahiya bi-tamleek) or AITAB (Al-Ijarah thumma Al-Bay), whereby the former is a lease that ends with an ownership transfer to the lessee, and the latter ends with a sale of the asset to the lessee. |

| Sukuk (Islamic bond) | An Islamic financial certificate that represents a portion of ownership in a portfolio of assets or earnings. Upon issuance, the issuer sells certificates to investors. The issuer then uses the proceeds from the certificates to purchase the asset, and the investors receive partial ownership of the asset, as well as are entitled to receive a portion of the profits generated by the asset. Sukuks can be structured in various ways, depending on the nature of the project and the appropriate underlying Shariah contract.

This differs from the conventional bonds, where investors are provided with coupons or interest payments. |

| Salam (Forward Sale) | A sale contract where goods are delivered at a future date and the sale price is fully paid in advance. |

Table 4: Summary of types of Islamic loans (Source: Adaptation from Bank Nizwa, ACCA Global, Corporate Finance Institute (CFI))

These contracts form the building blocks of Islamic finance worldwide, applied across a range of consumer products, business financing, and investments. In Singapore, several of these models are already available for retail and SME customers. However, as noted earlier, property financing remains a gap, with no Shariah-compliant mortgage products currently available due to CPF restrictions.

3. Why is Islamic Financing Better?

Islamic finance offers a values-based alternative to conventional financing. Instead of relying on interest, it utilises Shariah-compliant contracts, such as Murabahah (cost-plus sale) and Musharakah (partnership), to establish fair and transparent relationships between customers and financiers.

A key feature is the way penalties and late fees are handled. Under Shariah principles of justice (adl) and compassion (rahmah), customers can only be charged for actual out-of-pocket costs incurred by the financier. If any amount beyond this is collected, it must be channelled to charity rather than treated as profit. This ensures that penalties are not used as a source of income, but instead uphold fairness.

Islamic finance also appeals to businesses and individuals who prefer value-based choices. Because it is asset-backed or based and excludes harmful industries such as alcohol, tobacco, and gambling, it ensures financing supports activities with real economic and social value.

Ultimately, while rooted in Islamic principles, this approach is universal regardless of faith and religion. Its focus on fairness, responsibility, and value-based investment makes it a viable and attractive option for anyone looking for finance that aligns with the values of transparency and sustainability.

4. The Future Prospects of Islamic Financing in Singapore

Compared to regions globally renowned for their leading Islamic finance hubs and growing participation in the Islamic finance sector, such as the United Kingdom, the United Arab Emirates, and Saudi Arabia, Singapore is a relatively new player in the Islamic finance market.

Globally, countries such as the United Kingdom, the United Arab Emirates, and Saudi Arabia are recognised as prominent Islamic finance hubs. Singapore, by comparison, is still in the early stages of building its Islamic finance ecosystem—but momentum is growing.

A recent milestone was the launch of Etiqa’s first Shariah-compliant Investment-Linked Plan (ILP) in January 2025, showing that demand for Islamic products is starting to take shape locally. Furthermore, the Monetary Authority of Singapore (MAS) has taken important steps to support growth. For example, MAS removed the risk of “double taxation” on Murabahah transactions, so that Islamic financing is not disadvantaged compared to conventional loans. MAS also applies the same regulatory standards to Islamic banks as to conventional ones, and recognises structures such as sukuk (Islamic bonds) and Ijarah wa Iqtina (leasing) (MAS, 2021).

These measures create a fair environment for Islamic finance to develop in Singapore. Still, noticeable gaps exist in areas such as mortgage financing, bridge loans, and credit cards. Filling these gaps will be key to making Islamic finance more accessible and appealing to everyday consumers.

Looking ahead, Singapore’s strong position as a global financial hub, combined with its focus on innovation, makes it well placed to grow this sector. Fintech solutions and partnerships with established Islamic finance institutions in the region could accelerate this growth, offering both Muslims and non-Muslims more ethical and values-based financial choices in the years to come.

5. Conclusion

In summary, Islamic financing is gradually taking root in Singapore, with options now available for individuals, businesses, and institutions. While the Muslim population alone may not drive demand, the values at the heart of Islamic finance—fairness, transparency, and responsibility—can appeal to a much wider audience. For many, it offers an alternative to conventional finance that can sometimes create heavier burdens through interest-based arrangements.

Today, customers can already access Shariah-compliant solutions through banks such as Maybank and CIMB, ranging from deposit accounts and auto financing to SME and corporate facilities. Students and workers benefit from Mendaki’s interest-free education loans, while Ar-Rahnu offers an ethical alternative for short-term personal financing.

Mortgage financing remains a gap, but progress in this area would make a significant difference for Muslim homeowners. Encouragingly, new launches, such as Singapore’s first Shariah-compliant Investment-Linked Plan (ILP), signal that the market is opening up. With continued innovation, regulatory support, and demand for value-based choices, Islamic finance in Singapore has the potential to become a significant part of the country’s diverse financial landscape—offering benefits regardless of race, language, or religion.

Writers

Maryam Binte Aziz

Maryam is an incoming final-year Economics undergraduate at the National University of Singapore. Following her short stint at IFSG, she undertook a summer internship with CIMB Singapore, where she was attached to the Islamic Banking and Sustainability team.

Lukman

Lukman recently graduated from NUS with a degree in Real Estate and a second Major in Political Science. With a keen interest in Islamic Finance, he joined IFSG as an intern to learn more about the Islamic Finance scene in Singapore and help with their research efforts and events. He hopes to expand his knowledge in Islamic Finance and contribute to the field in the future.

Ustaz Huzhaifah Kamal

Huzhaifah Kamal is a Research Assistant with ISRA Institute, INCEIF University and a prospective PhD candidate. He has worked extensively on various Islamic Finance research projects, including Islamic Climate Finance, Value-based Intermediation, Islamic Intellectual Property Valuation, Islamic Social Finance, and Sustainability from the Maqasid perspective. He has also been involved in multiple research projects and initiatives with the Islamic Religious Council of Singapore (MUIS) related to fatwa. He holds an MSc in Islamic Finance from INCEIF University, a BA in Islamic Jurisprudence and its Fundamentals from the University of Jordan, and a BSc in Accounting and Finance from the University of London. He is also accredited as a Certified Shariah Advisor and Auditor (CSAA) by AAOIFI.

Editors

Ustaz Dr Zul Hakim Jumat

Dr. Zul Hakim Jumat is an Islamic Wealth Management Specialist at Maybank Singapore with over a decade of academic and professional experience in Islamic finance. As part of the pioneering Islamic Wealth Management Singapore team, he helps position Singapore as Maybank’s regional hub for Shariah-compliant wealth solutions across Southeast Asia and the GCC, with a focus on zakat innovation, takaful, Islamic structured products, and legacy planning. He is a Certified Shari’ah Adviser and Auditor by AAOIFI, co-editor of several publications including Islamic Finance in the Digital Age by Edward Elgar, and holds a Ph.D. in Islamic Finance and Economy from Hamad Bin Khalifa University, where his research developed a maqasid al-shariah screening framework integrating Shariah and ESG.

Mr Muhammad Ridhwaan Bin Muhammad Radzi

Mr Ridhwaan discovered his passion for Islamic Finance in his Pre-University studies at Madrasah Aljunied in 2013. Since then, he has completed three certifications on Islamic Finance, gained three service excellence awards during his national service at SCDF, completed his business degree at NTU, spent six years in the financial space (ING Bank, OCBC Bank, Amanie Advisors, Etiqa et al.) and is currently taking his CFA certification.He co-founded Islamic Finance Singapore (IFSG Ltd) and RizqX, the former a WhatsApp group turned Shariah Advisory firm, and the latter, a local fintech platform supported by NUS and NTU allowing the community access to halal public and private investments.

Ustaz Haron Masagoes

Ustaz Haron has more than a decade of Wealth Management experience in the Financial Services industry, specialising in Investment Advisory, as well as Islamic Wealth Management. He is also a Certified Shariah Advisor and Auditor (CSAA) by AAOIFI based in Bahrain, an Appointed Member of the Islamic Legacy Planning Workgroup (ILPW) by MUIS and a licensed representative in Singapore since 2010. Currently, he is the product and proposition lead for Maybank Islamic Wealth Management Singapore initiating the new Islamic Finance products and services to the market.

Ustaz Nasiruddin Hussen

Ustaz Nasiruddin is a Certified Shariah Advisor and Auditor (CSAA, AAOIFI) with a strong background in Islamic finance and Shariah advisory. He is the co-founder of BeShariahWise, a consultancy that guides clients in aligning their financial portfolios with ethical and Shariah principles. With experience across fintech, Islamic banking, and education, he is also active in teaching and promoting financial literacy within the community.

Ustaz Hamrey Mohamad

Ustaz Hamrey began his journey in Islamic Finance in 2012. He developed a keen interest while serving in the Wholesale Banking department at Al-Rajhi Bank Malaysia, specialising in Product Development. He is currently serving Warees Group which is a Government-Linked Real Estate Endowment Asset Management Firm. He has vast experience with Warees over the 8 years with the group. Some of his experience includes Wakaf Accounting, Wakaf Property Management and Land Optimisation Project Management. Ustaz Hamrey is also a qualified Chartered Islamic Finance Professional (CIFP – INCEIF) and a Certified Shariah Advisor & Auditor (CSAA – AAOIFI) with background in Islamic Law & Jurispudence from University of Al-Azhar, Cairo.

Mr Farik

Mr Farik is a senior banking professional at DBS Bank Ltd., where he is responsible for further strengthening the bank’s leading position in payments, fintech, and digital payment token services in Singapore and the region. Prior to joining DBS, he was with CIMB, covering money, payments, and fintech service providers, with additional responsibility for Islamic wholesale banking coverage. He began his career with the Islamic Bank of Asia Ltd., DBS Bank’s Islamic and private equity arm, and has extensive origination and execution experience in corporate banking, transaction banking, private equity, and Islamic product development and management.

Mr Hashim Bafadhal

Mr Hashim is Director of Ascent Islamic, an AAOIFIcertified Shariah Advisor & Auditor with a Masters in Islamic Finance Practice. A practitioner with more than 10 years advising personal and corporate clients, he is pursuing a Doctorate in Business Administration at École des Ponts Business School in Paris, researching prophetic leadership and ethical governance in Islamic financial institutions. Hashim also lectures and trains professionals on Islamic finance and leadership.

Mr Mohamad Azzad

Mr Azzad began his career at Maybank in 2002 as a Mobile Banking Executive. He subsequently took up position of Head of Direct Sales Management, overseeing business acquisition teams such as Retail Finance, SME Financing, Insurance Telemarketing and Card Telesales. In 2013, he transitioned into Branch Management, serving in roles such as Branch Manager as well as Head of Branch Optimisation. For the past 6 years, Azzad leads the Community Financial Services segment of Islamic Banking at Maybank Singapore.

References

- ACCA Global. (n.d.). Islamic finance – theory and practical use of sukuk bonds. Retrieved August 9, 2025, from https://www.accaglobal.com/sg/en/student/exam-support-resources/professional-exams-study-resources/p4/technical-articles/Islamic-finance—theory-and-practical-use-of-sukuk-bonds.html

- Azmat, S., & S. M. & B. K. (2014). The Shariah compliance challenge in Islamic bond markets. ideas.repec.org. https://ideas.repec.org/a/eee/pacfin/v28y2014icp47-57.html

- Bank Nizwa. (n.d.). Salam (forward sale). Retrieved August 9, 2025, from https://www.banknizwa.om/the-evolution/modes-of-islamic-banking/salam-forward-sale/

- CIMB Islamic. (n.d.). Singapore. Retrieved August 9, 2025, from https://www.cimbislamic.com/en/who-we-are/our-presence/singapore.html

- Corporate Finance Institute. (n.d.). Sukuk. Retrieved August 9, 2025, from https://corporatefinanceinstitute.com/resources/career-map/sell-side/capital-markets/sukuk/

- Hamzie, M. (2024, May 13). Overview of Asset-Backed financing in Islamic Finance – Halal Loans – Australia’s leading Islamic finance provider. Halal Loans – Australia’s Leading Islamic Finance Provider – Australia’s Sharia Compliant Loan Specialists. https://halalloans.com.au/overview-of-asset-backed-financing-in-Islamic-finance/

- Hisham, S., Shukor, S. A., Salwa, A., & Jusoff, K. (2013). The concept and challenges of Islamic pawn broking (Ar-Rahnu). Middle-East Journal of Scientific Research, 13, 98–102. https://doi.org/10.5829/idosi.mejsr.2013.13.1888

- International Shari’ah Research Academy for Islamic Finance (ISRA). (2023). Islamic financial system: Principles & operations (3rd ed.). ISRA.

- Kapital Boost. (n.d.). Kapital Boost. Retrieved August 9, 2025, from https://kapitalboost.com/

- Khan, H., & Bashar, O. (2008). Islamic Finance: Growth and Prospects in Singapore. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.1589796

- Leng, T. A. (2023, June 21). Singapore poised to become offshore Islamic wealth hub in next five years: panel. The Business Times. https://www.businesstimes.com.sg/international/asean/singapore-poised-become-offshore-Islamic-wealth-hub-next-five-years-panel

- Maybank. (n.d.). Islamic Banking. Retrieved August 9, 2025, from https://www.maybank2u.com.sg/en/personal/Islamic/index.page

- Monetary Authority of Singapore. (2021, July 1). Guidelines on the application of banking regulations to Islamic banking. MAS. Retrieved August 9, 2025, from https://www.mas.gov.sg/-/media/MAS/resource/legislation_guidelines/banks/guidelines/Guidelines-on-the-Application-of-Banking-Regulations-to-Islamic-Banking_01-Jul-2021.pdf

- Public Gold. (n.d.). Dealer Page. Retrieved August 9, 2025, from https://publicgold.com.my/index.php?route=dealer/page&pgcode=PG00833941

- Public Gold Marketing Singapore. (n.d.). Facebook. Retrieved August 9, 2025, from https://www.facebook.com/publicgoldmarketingsingapore/

- Rahman, A. (n.d.). Syariah-compliant mortgage financing in Singapore. LinkedIn. Retrieved August 9, 2025, from https://www.linkedin.com/pulse/syariah-compliant-mortgage-financing-singapore-abdul-rahman-bmh/

- Rosly, S. A. (2010). Shariah parameters reconsidered. ideas.repec.org. https://ideas.repec.org/a/eme/imefmp/v3y2010i2p132-146.html

- Shariah-compliant mortgage financing in Singapore. (n.d.). Islamic Finance News. Retrieved August 9, 2025, from https://www.islamicfinancenews.com/shariah-compliant-mortgage-financing-in-singapore.html

- ValueMax Singapore. (2023, August 16). Ar Rahnu. ValueMax. Retrieved August 9, 2025, from https://www.valuemax.com.sg/pawnbroking/pawn/ar-rahnu/faq/