Turaths & Todays: Muamalat Essentials

Regarding Sharikah and Modern Business Entities

A public company, as a legal business entity, is acceptable under the concept of sharikah (partnership) as long as it fulfils Shariah requirements. The price of shares must be mutually agreed upon by both parties involved in the transaction.

Shares, when viewed as representing ownership in a company, generally meet the basic principles of a shirkah contract. However, investors must ensure that the company is Shariah-compliant. This involves verifying whether the company’s core business and financial activities align with Islamic principles.

Before purchasing shares, investors should verify that the transaction process itself is also Shariah-compliant. Importantly, shares should not be purchased using loans that involve interest (riba), as this is prohibited in Islam. Investments must be made in a halal manner, using permissible funds.

Short selling is not permissible in Shariah. Although some have attempted to develop Shariah-compliant structures for short selling, to date, there is no widely accepted and accessible mechanism for this within Islamic finance.

Options trading is also not allowed. Promises of quickly multiplying money through speculative instruments, such as options, contradict Shariah principles. Options involve excessive uncertainty (gharar) and elements of gambling (maysir), which are prohibited.

Therefore, any investment activity must be carefully reviewed to ensure it is free from elements of riba, gharar, and maysir. Investors should seek advice from qualified Shariah advisors to ensure their investments comply with halal practices.

Shariah Screening Method

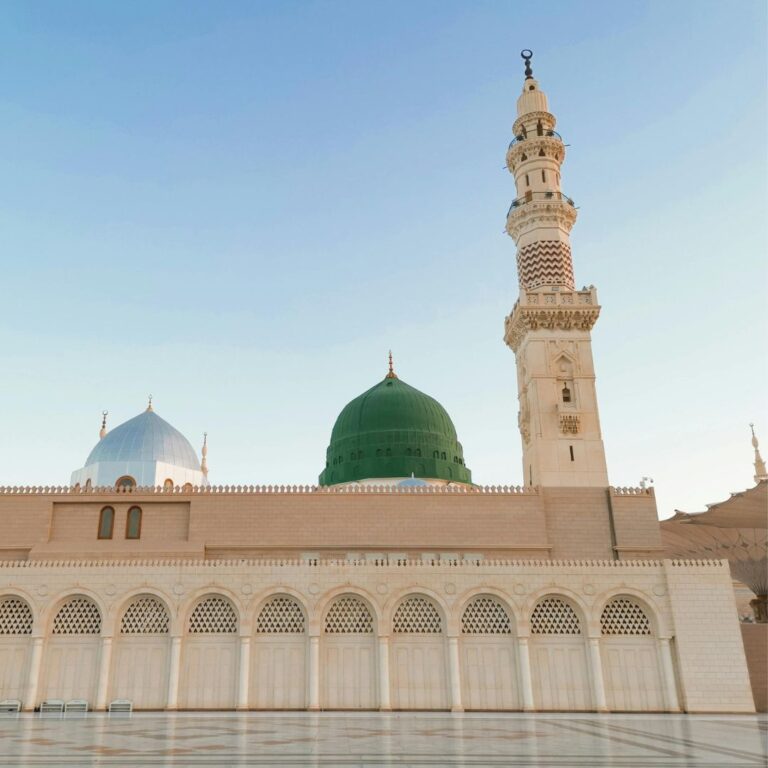

The concept of shirkah (partnership) has existed since the time of the Prophet Muhammad ﷺ. One clear example is the Mudarabah or Musharakah contract, where two or more parties pool their capital and share profits according to agreed ratios. This contract formed the basis of many early trade ventures in Islamic history.

In modern times, shirkah applies within the broader framework of muamalah (transactions), where the basic principle is that all commercial dealings are permissible by default (ibaahah). This principle is derived from the main sources of Islamic jurisprudence: the Qur’an, the Sunnah, Qiyas (analogy), and Ijma’ (scholarly consensus).

One crucial methodology used in Islamic legal reasoning is Istishhaab (presumption of continuity). When there is no clear text or ruling in the Qur’an or Sunnah, the default ruling remains permissible unless there is explicit evidence that prohibits it. Thus, any transaction is generally allowed unless there is clear Shariah evidence indicating it is haram.

Applying this to modern public shares, especially in Indonesia or any other country, scholars (ulama and fuqaha) continue to evaluate whether trading shares in public companies is halal or not. The underlying transaction — buying and selling shares — is permissible in principle, but upon closer examination, it may contain elements that conflict with Shariah principles.

The first and most crucial aspect is the nature of the company itself. Investors must check whether the company’s core business activities are Shariah-compliant. Does it engage in permissible activities? Does it avoid industries like conventional banking, gambling, alcohol, or other prohibited sectors?

Scholars exercise ijtihad (independent reasoning) to establish transparent Shariah screening methodologies that help Muslims identify whether a company qualifies as Shariah-compliant. However, there is no single universal standard applied by all Islamic finance institutions. Each country or Shariah board develops its screening methods and criteria.

For example, AAOIFI (Accounting and Auditing Organisation for Islamic Financial Institutions), based in Bahrain, provides widely used standards for Shariah-compliant business activities. Many platforms adopt these standards to help investors check compliance, such as Mumu or Zoya, which allow investors to screen companies using the AAOIFI criteria.

What exactly do they check?

AAOIFI and similar bodies generally focus on two main aspects:

- Business Activity Screening: Ensuring the company’s primary business is halal (permissible).

- Financial Ratio Screening: Making sure that any involvement in non-permissible income (like conventional interest or debt) stays within accepted thresholds.

Note that AAOIFI’s approach focuses on the halal aspect — it does not always extend to broader ethical concerns, such as environmental impact, sustainability, or social welfare (tayyib aspects). Today, there is growing interest in expanding the screening also to include ESG (Environmental, Social, and Governance) factors.

AAOIFI Shariah Standard on Shares

-

Business Activities Screening

According to AAOIFI, the first step in Shariah screening is examining the core business activities of a company. The Shariah non-compliant income of a company must be less than 5% of its total revenue.

Examples of Non-Shariah Compliant Activities include:

- Interest & Riba-based Income or Activities: Earning income through conventional interest or usury is prohibited.

- Gambling: Any form of betting, lottery, or speculative activities involving chance.

- Liquor & Liquor-Related Activities: Producing, distributing, or selling alcoholic beverages.

- Pork & Pork-Related Products: Any trade or production related to pork.

- Non-Halal Food & Beverages: Products that do not meet halal standards.

- Non-Shariah Compliant Entertainment: Entertainment that violates Islamic ethical values.

- Tobacco & Tobacco-Related Activities: Manufacturing or selling tobacco products.

- Other Sensitive Sectors: Businesses involved in weapons, defence, or other controversial areas.

Note: In certain countries like Singapore and Malaysia, the sale or production of weapons for national defence is typically viewed as permissible (maslahah ammah – public interest). However, in contexts like the US, where civilians may own weapons freely, this issue is more strictly scrutinised under Shariah.

-

Financial Ratio Screening

AAOIFI also requires companies to comply with specific financial ratios to limit involvement with interest-based elements.

The key ratios are:

- Interest-bearing debt to market capitalisation: must be less than 30%.

- Interest-bearing deposits to market capitalisation must also be less than 30%.

Market capitalisation is calculated by multiplying the company’s current share price by the total number of outstanding shares.

Rationale:

- Interest-bearing debt is prohibited in Islam. However, in reality, many companies rely on some conventional debt for their operations. Scholars, therefore, apply ijtihad (independent reasoning) to define a practical threshold.

- The 30% limit is derived partly from a hadith where the Prophet Muhammad ﷺ advised a companion not to give away all his wealth in charity, allowing one-third, saying, “A third, and a third is much” (wa-tsuluthu kathir). Scholars analogise this to mean that up to a third may be tolerated in some instances.

- Some standards use 33%, but AAOIFI prefers to be more cautious and sets it at 30%.

In short, if a company’s interest-bearing debt or deposits exceed this limit, its shares are not Shariah-compliant. The lower the debt, the better for compliance.

Why It Matters

Companies may hold significant cash reserves in interest-bearing accounts or use debt financing for operations. However, in Islam, investments must be based on tangible assets.

Buying shares should mean owning a portion of tangible business assets, not just trading in debt or speculative instruments. This is why Shariah scholars stress these limits — to ensure the investment remains in real, productive economic activity.

So, the question is: are we buying cash or buying debt? If this is a transaction of money for money, then it must be equal—currency for currency.

The goal is to grow wealth in a halal way. Practising fiqh muamalat today is not only about understanding classical texts but also about applying them carefully in the modern economic context, ensuring our investments remain ethical, tangible, and compliant with Shariah principles.

Question: What does interest-bearing debt mean? For example, if a company needs $100 million in funding and takes a loan with compounding interest charges, causing its interest-bearing debt to exceed 30% (for example, reaching 35%), does this mean it fails the Shariah screening threshold? Is this the correct way to understand the concept?

Answer:

The company can still be considered halal at the time of purchase. As investors, we need to continuously monitor because over time, a company might change from Shariah-compliant to non-compliant. What we buy initially must be halal — the point of purchase is halal.

Fund managers determine appropriate review periods, such as every 3 or 6 months, to compare and assess whether the investment remains halal or not.

For example, if we invest $100 in a Shariah-compliant company, but it becomes non-compliant after 6 months, what should we do?

In Malaysia, the Securities Commission and the Shariah Advisory Board conduct screenings every six months. From day 1 to 6 months, the company must remain Shariah-compliant. If the value of our investment grows from $100,000 to $150,000 by month 6 and it remains compliant, the full $150,000 is considered halal.

If the sale is delayed until month 8 and the value rises to $200,000, but the company has become non-compliant, the additional $50,000 (representing the growth after month 6) must be disposed of by donating it to charity. The original $150,000 is rightfully ours and remains halal.

This is how we treat companies that change from Shariah-compliant to non-compliant over time.

Question: How can we calculate the ratio if we don’t know the breakdown of the company’s activities?

Answer:

If the breakdown is unknown, we typically refer to the company’s financial report. Sometimes the company discloses detailed information and lists the business segments. If this information is not available, we can consult a Shariah advisor to confirm whether the company’s activities are Shariah-compliant.

Question: Regarding interest-bearing debt and interest-bearing deposits (which must be less than 30%), why do some screening methodologies like Dow Jones or S&P initially include accounts receivable and later remove them?

Answer:

There are two main reasons:

- Accounts receivable are money owed to the company in the future, not something the company currently holds in its possession. These amounts may or may not carry interest, depending on the creditors and payment terms. So, the key is to determine if interest is involved. Accounts receivable should generally not be counted under the 30% limit for interest-bearing debt or deposits.

- According to AAOIFI, the concept of bai’ dain biddain (sale of debt for debt) is not permissible. We must buy an asset or goods, not a debt. Therefore, selling or buying debt itself is not permitted, reinforcing the need to exclude accounts receivable as “debt” for screening purposes.

Question: In business screening, is it up to us to screen out companies with which we are not comfortable?

Answer:

We return to Ushul Fiqh and the relationship between the mufti (scholar) and the mustafti (seeker of a fatwa). Our responsibility is to ask for and rely on credible scholarly opinions. Once we receive a reliable fatwa, we have fulfilled our obligation and should act accordingly.

This is the beauty of Shariah: there is no single definitive interpretation for every matter. Many Quranic verses and hadiths are zonniy (ظني) — open to interpretation by qualified scholars. As seekers, we must seek credible fatwas. If one source is unclear, we may consult other reputable scholars.

In Islamic finance, it’s also essential to identify who the company’s Shariah advisors or committee members are and verify if they follow recognised standards, such as those of AAOIFI, Malaysia’s Securities Commission, or others. For example, Singapore lacks a standard, so we rely on established authorities like AAOIFI.

Question: If large companies have stronger financial circumstances compared to smaller startups, can we still invest in smaller companies that show potential?

Answer:

Yes, company size (large or small cap) does not exclude investment opportunities. Some smaller companies may already be Shariah-compliant and can be good investments.

Additionally, some companies that exceed the 30% debt limit may not be profitable yet, but they may still be Shariah-compliant if they raise funds without relying on debt.

A Quick Look into Other Forms of Investment

- Bonds: Not allowed

- Sukuk: Allowed

- Properties: Allowed

- Forex for Retail Investors: No retail forex meets Shariah compliance; therefore, it is not allowed

- Bitcoin and Cryptocurrencies: Depends on the asset being traded. If it is a tangible asset or can be converted into a real asset, then it is allowed. Otherwise, it is not.

- Gold: Allowed, subject to riba (interest) parameters. Transactions must be on a spot basis, where payment and delivery happen immediately, or the buyer places an order with a deposit upfront.

All investments must be free from prohibited elements to be considered Shariah-compliant.

Conventional Bonds

Bonds are investment securities in which an investor lends money to a company or government for a fixed period. In return, the investor receives regular interest payments (called coupons). When the bond reaches maturity, the issuer repays the principal amount to the investor.

(Source: Forbes)

Example:

A typical example is a bank loan that is packaged and sold as a security. For instance, a government issues bonds to raise funds and promises to pay interest over time. These bonds are then sold to investors as tradable securities.

What are Securities?

Securities are financial instruments that represent ownership (like shares) or creditor relationships (like bonds). They can be bought and sold in financial markets.

Characteristics of Bonds

- Priority over Shares:

Bondholders have a higher claim on assets and earnings than shareholders. If the company goes bankrupt, bondholders are paid before shareholders.

- High Liquidity:

Bonds are typically easy to buy and sell in the market without significantly affecting their price, allowing investors to convert them to cash quickly.

- Tradable in the Secondary Market:

Bonds can be bought and sold between investors after the initial issuance, providing flexibility and liquidity.

Shariah Issue with Bonds

Bonds are not allowed in Shariah finance because they involve riba (interest), which is prohibited in Islam. The fixed interest payments represent guaranteed returns regardless of the issuer’s actual financial performance, which contradicts the risk-sharing principles of Shariah-compliant finance.

For example, if you work in Singapore and are granted shares or bonds by your company as a reward, but these are not Shariah-compliant, here is some advice:

The amount you receive can be considered a measure of your purchasing power. You should dispose of (sell) that asset to a third party. The amount received from the sale must correspond to the value of the item initially given.

For instance, if you are granted $10,000 worth of stocks that are non-Shariah-compliant and you sell or trade them later for $20,000, the additional $10,000 profit should be given to charity.

The rulings on securities and government bonds are applicable here, as they fall within areas that have Shariah concerns.

For depositors placing money in Islamic banks, an alternative is to invest in Islamic bonds, also known as Sukuk, which comply with Shariah principles.

Sukuk

Literal Meaning:

The word Sukuk is the plural of sakk, which means certificate, legal instrument, deed, or cheque.

Sukuk is allowed and halal.

Technical Definition:

In the context of money and capital markets, Sukuk refers to certificates or securities that represent financial rights arising from underlying trade or other commercial activities.

- According to ISRA, Islamic Capital Markets: Principles and Practices, Sukuk are certificates of equal value representing undivided shares in ownership of tangible assets, usufruct, services, or assets of particular projects or special investment activities.

- According to AAOIFI Shariah Standards, Sukuk is a Shariah-compliant alternative to conventional bonds.

Sukuk Ijarah Structure

Phase One: Sukuk Issuance (Primary Market)

- Step 1: Investors provide cash (proceeds) to buy Sukuk.

- Step 2: A Special Purpose Vehicle (SPV) issues Sukuk certificates representing ownership of assets and associated rights.

- Step 3: The Obligor (the party needing funds) sells an asset to the SPV (representing the investors) in exchange for the Sukuk proceeds.

Parties involved: Investors ⇄ SPV ⇄ Obligor

Phase Two: Duration of Sukuk

- Step 1: The SPV leases the asset back to the Obligor for a specified period (tenure) and at an agreed rental amount (coupon).

- Step 2: The Obligor makes periodic lease payments to the SPV, which distributes these payments to investors as returns.

- Step 3: During the tenure, Sukuk can be traded in the Secondary Market, providing liquidity.

- Step 4: A buyer in the Secondary Market can purchase Sukuk from an existing investor, becoming entitled to future lease payments.

Parties involved: SPV ⇄ Obligor ⇄ Investors ⇄ Buyer (via Secondary Market)

Phase Three: At Maturity

- Step 1: At maturity, the Obligor purchases the asset from the SPV for an agreed-upon amount.

- Step 2: The proceeds from the sale are used by the SPV to redeem the Sukuk, repaying the investors their capital.

Overall Outcome:

- The Obligor receives funding for its needs.

- Investors (Sukuk holders) provide financing and receive periodic lease returns.

- The secondary market provides liquidity for investors who wish to sell their investments before maturity.

- At maturity, the asset returns to the Obligor, and Sukuk holders receive their principal back.

As Muslims, we want to transact in a halal manner, compliant with Shariah. When buying and investing, it’s not enough for the investment to be halal — we must also consider it from an investment and commercial perspective. Even if we invest in Shariah-compliant assets, ensure they are not only halal but also sustainable and capable of growth. It must be financially sound with a good strategy, and ultimately, that is what matters: thayyib (good and wholesome).

A Little Advice:

- Share trading carries risks.

- Invest safely.

- Have a sound investment plan and strategy.

- Consult your financial and Shariah advisors for their expertise.

- Do not invest your emergency funds in shares.

- Only invest the amount that you can afford to lose in shares.

Question: So, if I want to invest in a global company using AAOIFI standards, but I’m looking to invest in Malaysia under the Securities Commission (SC) guidelines—which also refer to AAOIFI standards—why don’t I choose the most lenient standard available?

Answer:

The screening methodology in Malaysia tends to be more lenient. For example, they permit companies to have debt exceeding 30% as long as the debt is Shariah-compliant. So, if a company has 50% debt, but it’s from an Islamic Bank, it’s still allowed in Malaysia. However, according to AAOIFI standards, this would not be permissible.

As a fund manager, to invest and buy securities in Malaysia, we must comply with the regulations set by the Securities Commission. Additionally, regulatory requirements must be followed in conjunction with Shariah considerations.

Question: Is there any discussion about changing the 30% ratio?

Answer:

These standards have been deliberated and developed over several decades; however, the methodologies continue to evolve. Islamic finance is still progressing and requires time to reach a final, definitive outcome.

As Muslims, we strive to do our best and make earnest efforts.

Fiqh involves deliberation and adaptability—what we do in one situation might differ in another.

إٍذَا دَقَّ الأَمْرُ اِتَّسَعَ، وَإِذَا اِتَّسَعَ الأَمْرُ دَقَّ

Meaning: When a matter is complex, seek the easier path; and when the easier route is found, follow it.

https://islamicfinance.sg/summary-class-10/