Turaths & Todays: Muamalat Essentials

QnA before entering the session.

Question: Is working in a company that invests in sports betting considered haram?

Answer:

Yes, but you have to look at it and deconstruct it. It depends on the nature of the company’s core activities and your specific role. If the company’s primary business operations are Shariah-compliant and your salary is derived from permissible services, then it is generally acceptable.

However, if the company allocates some funds to invest in sports betting, but such activities are not part of its primary business and your role is unrelated to them, this may still be permissible.

On the other hand, if the company’s main activity revolves around sports betting or a significant portion of its investments is in such areas, and your role is directly involved with these activities, then this raises serious Shariah concerns. In such a case, it is advisable to seek alternative employment if possible.

Nonetheless, if you are currently working there due to necessity—such as needing to provide nafaqah for your family—this may be considered a state of darurah (necessity). Even so, you should strive to find a more Shariah-compliant opportunity as soon as possible.

Wakalah (الوكالة)

Definition of Wakalah

Before evaluating the ruling on any particular contract, it is essential to understand its true nature. This is based on a foundational principle in Islamic jurisprudence:

الحُكْمُ عَلَى الشَّيءِ فَرْعٌ عَنْ تَصَوُّرِهِ

“The ruling on something is a branch of understanding its nature.”

Hence, scholars begin their discussions by first developing a sound understanding of the subject matter.

Linguistically, Wakalah from the word at-tafwiidh,means entrusting, delegating, or empowering another. Technically (in Islamic law), Wakalah is the act of empowering someone else to act on one’s behalf, in matters where deputisation is allowed, and within a defined process. This agency becomes invalid upon the death of either party, as a deceased person cannot hold or issue an agency.

Wakalah can occur in two situations:

- When a person is absent or unable to perform the task themselves.

- When a person delegates someone else intentionally for efficiency or necessity.

Everyday Examples of Wakalah (Agency)

Before discussing the pillars (arkaan) of wakalah, it is helpful to explore practical examples of how agency is commonly applied in everyday life.

1. Marriage Contract (Akad Nikah)

Can someone appoint a representative (wakil) to act on their behalf in marriage?

Yes, it is permissible in Islam.

In a typical nikah (marriage) contract:

- The responsibility of performing theakad lies with the wali (guardian) of the bride, usually her father.

- In contexts such as Singapore, it is common for a Naib Qadi (Deputy Qadi) to act on behalf of the bride’s father, especially if he is unable to be present.

- In cases where the bride has no eligible wali—for example, a convert whose non-Muslim father cannot act as wali—the Qadi can assume the role of wali.

- The Qadi may then delegate this authority to a Naib Qadi or another appointed wakil to conduct the marriage.

This is a precise instance of wakalah in religious and legal practice, where representation is both permissible and functional.

2. Share Trading through a Broker

Another common application of wakalah is in financial transactions, such as buying shares.

- When an individual is unable or unqualified to execute the transaction personally, they may appoint a broker to act on their behalf.

- The broker carries out the purchase or sale, typically in exchange for a commission.

- This is an example of wakalah bil ujrah (agency with compensation), where the agent (broker) is paid for the services rendered.

3. Overlap between Wakalah and Ijarah Contracts

There are similarities and overlaps between:

- Wakalah bil ujrah (paid agency), and

- Ijarah (contract of hiring or leasing services).

Types of Ijarah:

- Ijarah al-A’yan: Leasing physical items (e.g., renting a car).

- Ijarah al-Abdaan: Hiring someone for their services or labour (e.g., contracting a worker).

At times, when someone is asked to perform a task on your behalf, it could be:

- A wakalah (if it’s a mandate to act in your name),

- Or an ijarah (if it’s a direct service in exchange for payment).

The distinction lies in the intention and structure of the agreement, though both contracts are valid and recognised under Islamic law.

The Arkaan (Essential Elements) of Wakalah (Agency)

There are four essential elements (arkaan) of the contract of agency in Islamic jurisprudence:

- Principal / الموكل (Al-Muwakkil). This is the one who delegates authority to another to act on their behalf.

- Agent / الوكيل (Al-Wakiil). The one who is appointed to perform the authorised act.

- Authorised Act / الموكل به (Al-Muwakkal Bihi). The specific task or matter delegated to the agent must be Sharia-compliant and legally executable by a proxy.

- Agency Procedure / الصيغة (Sighah). The offer and acceptance (Ijab and Qabul) that establish the agency relationship.

Wakalah as a Voluntary Contract (Tabarru’)

In its original form, wakalah is a tabarru’ contract (non-compensatory or voluntary contract).

- This means that the agent does not receive any payment for performing the task.

- It is done purely out of goodwill or cooperation.

For example:

- A father, who is the wali in a marriage contract, may ask his brother or son to represent him.

- Since this is a voluntary delegation, if the appointed person fails to act, there is no legal ground to claim compensation or enforce performance.

- Similarly, suppose someone agrees to buy you a meal and later forgets. In that case, you cannot legally compel them to fulfil it or ask for damages—even if you suffer inconvenience (e.g., lack of concentration at work).

In such cases, the voluntary nature of the contract means that it can be exited without liability.

Wakalah with a Fee (Wakalah bil Ujrah)

However, if the agency involves a fee or compensation, it becomes a contract of exchange (‘uqud mu’awadhah), and the implications change significantly:

- Once the agent accepts the assignment, they are obligated to perform it.

- The principal has the right to demand performance and may even seek compensation for non-fulfilment.

- Thus, although the contract type is still wakalah, the presence of a fee introduces binding obligations and potential legal consequences.

Even though it’s the same contract type (wakalah), the presence of monetary consideration changes the legal implications and consequences. That’s why it’s important to know:

Is this agency based on trust and goodwill, or is it a contract of exchange?

Practical Application in Islamic Finance

This distinction is crucial in modern Islamic finance.

- For example, in Malaysia, the Shariah Advisory Council of Bank Negara Malaysia has ruled that:

“Suppose an agent accepts a task and fails to perform it, and such failure leads to financial consequences. In that case, the agency becomes obligatory—even if it was initially agreed upon without any remuneration.”

This principle reflects the understanding that, although wakalah in its original form is a tabarru’ contract (voluntary and non-compensated), it can become legally binding if its non-performance results in financial repercussions for the principal.

- Consider car financing in Singapore:

For example, let us consider a situation where, as customers, we enter into a car financing contract with an Islamic bank in Singapore. Under this arrangement, the asset (car) legally belongs to the bank. However, suppose we carefully review the financing documents. In that case, we may find that the bank has appointed us as agents (wakil) to purchase an insurance policy for the vehicle, ensuring that the asset is adequately protected.

If we fail to carry out this task, and that failure results in financial consequences (e.g., damage to an uninsured car), we may be required to cover the costs from our own funds.

Now, in many cases, this agency appointment does not involve a fee, which means that—technically—it could be seen as a voluntary contract. However, because this responsibility has been explicitly agreed upon, and its non-performance carries potential financial implications, the contract automatically shifts from a voluntary nature to one that is binding and must be fulfilled.

In other words, once such a risk is involved:

- You cannot simply withdraw from the task,

- Nor can you refuse to perform it without consequence.

In the Islamic finance industry, this reflects a broader principle:

Even if a wakalah contract begins as voluntary, if the nature of the task involves financial implications—especially those that may harm the principal (e.g., the bank)—then it becomes obligatory. The agency exists in its original voluntary status and must be carried out responsibly.

Conditions for the Principal (Muwakkil)

- Capacity to Act Personally

The principal must be able to perform the act themselves if they choose not to delegate. Only the person who holds the rights or authority over an act may appoint an agent to do it on their behalf.

Example:

when we are dealing with Tiger Brokers, we hold a brokerage account in our own name and have already placed an order to buy certain Nvidia shares at a specified price. Only we, as the account holder, can instruct Tiger Brokers to execute the order on our behalf. We cannot have our spouse go to Tiger Brokers and say, “I want you to buy such and such shares on our behalf,” because our spouse has no authority to perform our personal transactions.

We are supposed to carry out such transactions ourselves. Only we can appoint someone else to do it on our behalf if we do not wish to do it personally. This reflects the principle of sihhatu tasarruf – we must have the capacity to perform the transaction ourselves to appoint another person to do it on our behalf.

- Legal and Mental Capacity

If the person lacks capacity (e.g. due to dementia or being a minor), they cannot appoint an agent. In such cases, decision-making falls to the legal guardian or closest relative.

Conditions for the Agent (Wakil)

- The agent must be able to directly perform the transaction or act for which permission is granted.

In modern terms, the agent should have the necessary capacity, expertise and ability. If the agent knows they lack the skills or capacity, they must be responsible enough to decline the appointment.

- The agent must also be appointed directly by the person who has the legal right or mandate to perform the act (the Principal).

An appointment cannot be made by someone else on the principal’s behalf without their authority.

Example:

Appointing a lawyer to handle legal matters is a form of agency (wakalah), which may also involve a fee (wakalah bil-ujrah). However, under Shariah rules, a person who lacks mental or legal capacity, such as someone with dementia or a minor, cannot appoint an agent or lawyer to act on their behalf. In such situations, decision-making responsibility falls instead to the next of kin or legal guardian, such as children or closest relatives. The same principle applies to someone considered as-safih (financially irresponsible or incapable): they cannot authorise transactions themselves; decisions must be made by their guardian.

Conditions for the Authorised Act

- Principal’s Ownership/Power

The principal must have ownership or the right to deal with the item or matter.

- Delegability

The act must be capable of delegation. Business and financial transactions can usually be delegated, whereas acts of worship (ibadah) generally cannot.

Exceptions:

-

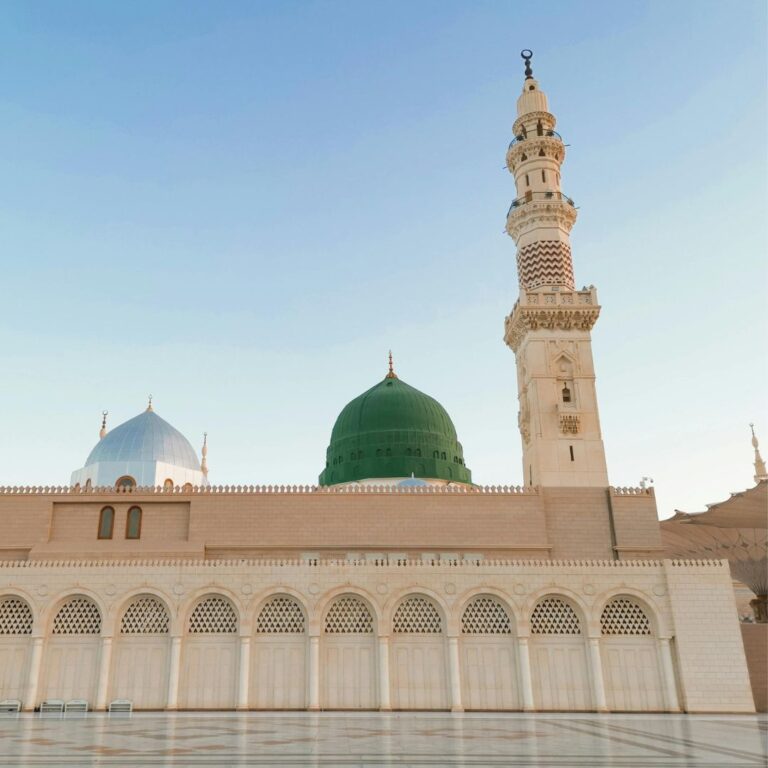

- Badal Hajj (Hajj by proxy) – permitted if one is physically unable, as practised in the Prophet’s time.

- Zakat – someone may be asked to pay zakat on one’s behalf if one is unable or busy.

- Clarity In Some Aspects

The object or matter delegated must be known and understood by both the principal and the agent.

Conditions for the Agency Procedure

- Mutual Consent

There must be an expression of agreement by both principal and agent. This can be achieved through an offer and acceptance, either in writing or verbally.

- No Rejection

Neither party should reject the arrangement after it is offered.

- Clarity of Terms (Absence of Conditionals or ta’liq)

Agency contracts should clearly set out what the agent is authorised to do. Although “conditional” delegation (ta’liq) is generally discouraged, modern juristic and Fuqoha discussions allow setting parameters or conditions.

Example:

when a person appoints someone to handle investments. The principal has the capacity, skill and authority to invest and says to the agent: “I want you to invest this SGD 100,000 only in Nvidia and Google shares, and not in anything else. Your fee and commission will be such and such.” This is an investment agent with a specific mandate.

It can also happen that the principal does not have the ability or knowledge to invest. In that case, he may appoint an investment agent and give him a mandate to decide and determine the investments on his behalf.

Sometimes, an agency cannot be entirely open-ended. There are situations where you may set conditions for how the agent should act. For example: “Hold on to my money and only buy shares in Microsoft if the price drops to £250. If it is more expensive, do not buy.” This shows that a wakalah contract can be parameterised – you can place specific conditions and limitations. People sometimes misunderstand the term “adamu ta’liq” (no conditions), but in modern practice, as mentioned before, scholars have explained that ta’liq (conditional instructions) can be permitted in agency.

However, conditions that go against the nature of wakalah itself are not allowed. An important concept in muamalat is “dhoman” (liability). When you give someone money to perform a transaction, that person is acting on your behalf, and the liability still rests with you.

Another Example:

Appoint someone to buy a car from a Toyota dealer. On the way, the money is stolen or the agent is robbed. Under a standard agency contract, you cannot insert a clause saying “Once the money goes to you, you are responsible and must compensate me if it is lost.” Unless the agent has been negligent or has committed wrongdoing, the loss remains your liability.

Similarly, if you appoint someone to invest money for you, the capital is still yours. If the investments fall by 50 per cent due to market conditions, you cannot demand that the agent reimburse you simply because you appointed them. That would go against the spirit and purpose of the contract, because you are asking someone to act on your behalf, but ownership and liability remain with you.

Agency Procedure (Suurotul Wakalah)

Zaid says to Amru, “I delegate the selling of my house to you.” Amru replies: “I accept,” or remains silent. In an agency, silence combined with no objection can amount to acceptance. The essential point is that both parties understand what is being communicated, and that Amru has the capacity to act.

This is the basic procedure of wakalah: an offer by the principal, acceptance (or non-rejection) by the agent, and both parties having capacity and understanding of what is being agreed.

The classical texts do not go into detail on wakalah bil ujrah (agency with a fee). When you appoint someone and pay them, the arrangement sits under a contract of exchange (mu’awadah), as mentioned earlier. In modern practice of wakalah — for example appointing someone to invest — the agent cannot guarantee outcomes, because he acts on your behalf, not as a guarantor.

It is also important to distinguish between the contract of agency (wakalah) and other agreements. You need to be mindful of whether the act is purely voluntary or whether it has been changed into a contract of exchange.

Example:

Another modern example is property agents. When you agree a commission upfront for a specific transaction, it is more akin to a ju’alah contract: “If you succeed in doing this, you will receive this reward or commission.” Property agents often work without an upfront fee. They show properties, connect with other agents and try to close deals. If in the end you do not buy or sell, the agent may receive nothing. This is not a true wakalah, because in wakalah you appoint someone to act on your behalf and, by right, you pay for that service as part of the transaction taking place.

The key premise is that all parties must understand clearly what agreement and contract they are entering into, and on what terms.

Question: Can a wakalah (agency) contract be withdrawn?

Answer:

Yes, it can — but it depends on the nature of the contract.

- If it is a voluntary arrangement (no fee), either party may withdraw at any time.

- If it is a paid contract (wakalah bil ujrah), withdrawal must follow what has been agreed by both parties. You cannot unilaterally withdraw from an appointment that involves consideration.

For example, if you have been paid to carry out certain tasks, you cannot simply say, “My teacher told me wakalah is voluntary, so I do not wish to continue, and I will keep the money.” This is not allowed because you have been paid to perform the wakalah.

Once you have accepted the appointment and entered into it, you are bound by the agreement. If withdrawing causes financial loss to the principal, you cannot just walk away. In short, you cannot arbitrarily exit the contract.

Question: In a situation where an agent cannot or does not have the capacity, can the wakalah contract be withdrawn?

Answer:

This goes back to the basic conditions of an agent: he must be capable of performing the delegated act. An agent should be responsible enough to know which type of agency he can accept or decline, and the principal should ensure that the person appointed is actually competent.

The principal may generally withdraw a wakalah appointment at any time. However, where a fee is attached, there must be a clear understanding. If the principal wishes to terminate the arrangement, the fee may have to be prorated. Suppose the principal unilaterally ends the contract without agreement despite a financial arrangement at the outset. In that case, he is still bound by that commitment, and the agent retains the right to the agreed fee.

Conversely, if an agent suddenly withdraws in mid-performance and this causes loss, he must refund or compensate the principal for any money already received.

Illustration – Wakalah Sukuk

Wakalah sukuk refers to the use of wakalah contracts in issuing Islamic bonds. In conventional bonds, governments or companies raise funds by issuing bonds promising repayment plus interest on agreed dates.

Islamic bonds serve a similar purpose but are structured to be Shariah-compliant. The issuer receives money from investors and acts as their agent (wakil) to invest those funds, taking an agreed-upon upfront fee.

Sometimes, the wakalah is purely an investment agency; at other times, it may be combined with other contracts, such as mudarabah. Hybrid structures are common – for example, 50% invested in listed assets and 50% in direct business activities. In Malaysia, sukuk wakalah often requires at least 30% of proceeds to be backed by actual assets, while the remainder may go into murabaha or tawarruq arrangements, which are debt-based.

Because of these variations, the parameters of wakalah in such instruments must be clearly understood by all parties.

Question: How does “self-checkout” relate to wakalah?

Answer:

When we use a self-checkout machine to pay, we are acting for ourselves as the buyer, while the machine serves as an interface acting on behalf of the supermarket. It represents the owner of the goods. In this sense, there is a form of wakalah from the seller’s side – the system is authorised to complete the transaction on the supermarket’s behalf.

A similar situation applies to vending machines. Several parties may be involved: the owner of the products, the owner or renter of the machine, and the payment processor. Each acts on behalf of another in different parts of the transaction. This can also be viewed as a form of wakalah.

Question: Membership

Answer:

Generally, membership involves paying a fee in exchange for specific benefits. It is important to be very clear about what the membership covers.

- Example – Gym membership: You pay a set fee for the services and facilities stated in the package offered by the gym. This is essentially a contract of ijarah (leasing), where you benefit from using a facility that you do not own (ijarah al-‘ayan).

- Example – Safra membership: By becoming a member, you are entitled to use certain facilities or receive discounts. The fees should clearly state what benefits you are entitled to. In this case, the fee is paid in consideration of receiving benefits at a reduced cost.

- Example – Associations: For instance, asatizah (Islamic teachers) in Singapore can join PERGAS. They pay monthly or annual fees. The membership fee must be clearly explained – what programmes it supports, what participation or training sessions are included, and so on.

In short, membership fees are typically treated as a form of ijarah or a service agreement, and both the provider and the member must clearly understand what is being offered in exchange for the fee.

Question: Fractional Reserve Banking

Answer:

Fractional reserve banking is a monetary policy tool used by governments to manage the supply of money. Banks are required to keep a portion of deposits with the central bank (the “reserve requirement”) and may lend out the remainder.

For example, if the reserve requirement is 30%, a bank receiving a deposit of USD 100 must keep USD 30 in reserve and may lend out USD 70. Today reserve ratios vary widely — 2.5%, 5%, or even lower.

Critics argue that fractional reserve banking creates “money from nothing” and fuels inflation. For instance, if you deposit USD 100 and the reserve requirement is 10%, the bank can lend USD 90 to someone else. That person deposits the USD 90 elsewhere, and the process repeats. The same initial USD 100 ends up circulating as multiple claims on money, inflating the total recorded “money” in the system.

From a Shariah perspective, the key point is that some proportion is at least kept as reserve. But even without a formal reserve requirement, the same effect can occur in any community if funds are continually re-lent — it’s a matter of accounting. In Islamic finance, a bank may take a USD 100 qardh (loan) from a depositor and invest it in a business. It owes the depositor USD 100 and has an asset of USD 100 invested. That USD 100 may then be re-lent, producing a similar multiplier effect.

Therefore, fractional reserve banking by itself is not a valid reason to declare Islamic banking haram. The key issues are transparency, proper contracts, and Shariah-compliant structures — not merely the existence of a reserve system or the money-creation effect.

Question: Is playing a claw machine (an arcade machine with plush toys) permissible?

Answer:

It depends on your intention and on how the game is structured. If you put in £1 with the clear understanding that you are paying for the experience of playing the game — and the toy is only a bonus if you succeed — then this is generally permissible. You are essentially paying for entertainment, and the prize is an added extra.

However, if your main intention is to win the toy and not to play, and you may end up with nothing despite paying, then the activity resembles gambling. The essence of gambling in Shariah is that you pay money for a chance to gain something of higher value but risk getting nothing in return. In such a case, primarily when the losses of other players fund the prizes, it becomes problematic.

Because this area can be grey, the safest approach is to avoid it if you are doubtful, following the hadith:

دَعْ مَا يُرِيبُكَ إِلَى مَا لَا يُرِيبُكَ

“Leave that which makes you doubt for that which does not make you doubt.”

A similar principle applies to competitions. For instance, if you organise a futsal tournament and charge teams an entry fee, the prize money should not be funded directly from the entry fees of the participants. From a Shariah perspective, the prize should come from separate funds (the organiser’s own money or a sponsor) while entry fees can be used for administration or running the event. This separation avoids the element of gambling.

Hence, Islamic commercial practice calls for transparency, proper capacity, and fairness between parties. Whenever doubt arises, one should err on the side of caution and choose structures that are unambiguously compliant with Sharia principles.

https://islamicfinance.sg/summary-class-11/