Islamic Financial Activities in Singapore: Context and Developments in a Secular Country with a Muslim Minority Community[1]

Zubir Abdullah, December 2025

Discussions on Islamic finance often focus on the financial asset classes of Islamic banking, Islamic bonds (sukuk), Islamic funds, and Islamic insurance (takaful), especially in Muslim majority countries such as Malaysia and the Gulf Cooperation Council (GCC) nations – Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the UAE.

However, Islamic financial activities are also conducted by non-bank financial institutions. Further, finance in Islam goes beyond commercial transactions – almsgiving (zakat), for instance, is one of the five pillars of Islam and emphasizes the moral use of wealth to aid the needy and benefit society.

In Muslim-majority nations, governments are expected to develop and support the conduct of Islamic financial activities as part of their religious duty (ibadah). In contrast, secular states with Muslim minority communities, like Singapore, do not have this institutional responsibility. Still, Muslims in such contexts are obliged to conduct their financial affairs in accordance with Shariah. These efforts serve as valuable case studies for both minority and majority Muslim communities.

This paper examines Islamic financial activities in Singapore. Two main drivers have shaped its development: the Muslim community’s own financing needs and the Monetary Authority of Singapore’s (MAS) developmental initiative to attract Middle Eastern wealth for management in Singapore.

The discussion begins with the role of finance in Islam, followed by the Singaporean context, and concludes with an overview of key developments in Islamic financial activities within the nation.

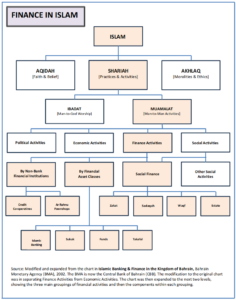

Islamic Finance: A Broad Framework

An overview of the place and role of finance in Islam is illustrated in Annex 1. Financial activities are under the Muamalat branch of Islamic Law (Shariah), dealing with man-to-man activities. There are three main groups of Islamic financial activities:

a. By financial asset classes – this includes Islamic banking, sukuk, Islamic funds and takaful.

b. By Non-Bank Financial Institutions (NBFIs) – they provide an alternative avenue of financing to asset classes. The main Islamic NBFIs are the Islamic credit cooperatives (co-ops) and the Islamic pawnshops (Ar Rahnu).

c. Social Islamic Finance – this consist of zakat, sadaqah (voluntary donations), waqfs (permanent endowments) and Islamic estate management (wassiyah and Faraid).

Development of Islamic financial asset classes started in the 1950s and 60s, and by the 1990s, these Shariah-compliant alternatives to conventional banking, bonds, funds and insurance have gained global traction. The Islamic Financial Services Board (IFSB) estimated that the volume of Islamic financial assets grew from US$1.58 trillion in 2012 to US$3.38 trillion in 2023 – a 113% increase. Islamic banking is the largest group of financial assets (about 70%), followed by sukuk (25%), Islamic funds (4%) and takaful (1%). The GCC region accounts for over half of Islamic financial asset activities, followed by Southeast Asia and the broader MENA region (essentially Egypt, Iran, Jordan and Sudan). Despite its growth, Islamic finance remains marginal globally – Islamic banking assets represent only 0.6% of the world’s US$410 trillion in total banking assets.

The Islamic NBFIs offer Shariah-compliant financing outside of the banking sector. While Islamic credit co-ops are common in Malaysia and Indonesia, such Islamic co-ops are rare in Arab states due to banking restrictions. In Muslim-minority countries, Australia has notable examples like MCCA Islamic Finance & Investments and Islamic Community Finance Australia Limited (ICFAL). Singapore’s own experience, though lesser known, is instructive. The Ar Rahnu pawnshop is another NBFI which provide short-term loans secured by valuables, without interest. This model, pioneered by Malaysia in 1992, is now present in Singapore, Brunei, Indonesia, and Thailand.

Islamic social finance – zakat, sadaqah, and waqf – reflects both spiritual and ethical commitments, creating a financial ecosystem rooted in community benefit. Estate planning under wills (wassiyah) and inheritance (faraid) also contributes to intergenerational wealth distribution.

Singapore’s Context

Singapore is a small, yet economically significant nation located at the tip of the Malay Peninsula. Despite its modest size (735.7 sq km), it ranks among the world’s top financial centres, boasts the highest GDP per capita globally and is one of only eight countries with the highest triple A credit rating from the top three credit rating agencies.

Singapore is a secular, multiracial country. However, its Constitution has two important provisions:

- Article 152 affirms the government’s duty to care for racial and religious minorities, including the indigenous Malay/Muslim community.

- Article 153 mandates legislation for regulating Muslim religious affairs and establishing a council (MUIS) to advise on such matters.

Singapore’s Muslim Community

Annex 2 provides a profile of the Muslim community in Singapore and highlights three important developments in recent years:

a. The proportion of Muslims in Singapore’s population has decreased from 16.3% in 1980 to 15.6% in 2020, while Malays continue to be the largest ethnic group among the Muslims. Hence the Muslim community in Singapore are usually referred to as the Malay/Muslim community.

b. Significant improvements in the highest educational qualifications of Muslims with implications for higher income levels, collection of zakat on wealth and contributions for sadaqah and waqfs.

c. More Muslims have reached the age where they can withdraw from their retirement savings in their Central Provident Fund (CPF) accounts, providing increased liquidity for Islamic financial activities in Singapore.

The Malay/Muslim community’s use and association with Islamic financing reflects the socio-economic development of the community since the establishment of the British trading post in Singapore in 1819.

In the first few decades of Singapore’s development as a regional port and trading hub, the bulk of the Muslim community were the Malay fishermen and subsistence farmers with hardly any education. The influx of Muslim merchants and traders from the Middle East, the Indian sub-continent and the surrounding Malay Archipelago saw the emergence of a more affluent and educated group of Muslims in Singapore. They generously gave back to the community by establishing waqfs to build mosques and madrasahs, as well as playing significant roles in establishing Malay/Muslim organisations (MMOs) to provide needed social and welfare services. The first waqf for building a mosque was established in 1820. The earliest MMOs were the Muslimin Trust Fund Association (MTFA) established in 1904 and Jamiyah Singapore established in 1932. Both continue to be operational today and are funded mainly by zakat contributions and public donations. MTFA runs the two Darul Ihsan Muslim orphanages in Singapore and providing burial services for the poor and the unclaimed Muslim bodies. Jamiyah provides a wide range of missionary, social and welfare services for the Malay/Muslim community.

Up to the 1980s, the proportion of Malays in Singapore that are English-educated and had tertiary qualifications were relatively smaller than other racial communities. These educated Malays mainly gravitated towards the teaching profession and the civil service (including MUIS when it was established). Unsurprisingly, it was the Singapore Malay Teachers Co-operative that led efforts to establish the first takaful operations in Singapore in 1995, the first Islamic banking window in 1998, and subsequently later their own Islamic Credit Co-operative. In seeking effective ways to carry out their responsibilities, it was the civil servants in MUIS that innovated on issuing the first sukuk in Singapore in 2001 to fund the development of the wakf properties.

In 1982, the community leaders, professionals and political leaders were galvanized to establish Yayasan Mendaki, to address the low educational levels and related social issues of the Malay/Muslim community that was starkly highlighted by the 1980 Population Census. Mendaki’s initial efforts was in establishing Tuition Centres to assist the weak Malay/Muslim students. Their initiatives have since expanded to provide educational assistance at all levels for the community. While Mendaki received funding from Muslim workers through CPF deductions, zakat contributions and public donations, they also explored other means of Islamic funding. In 1991 Mendaki launched Singapore’s first Islamic fund, and in 1999 the first Islamic credit co-operative. Other MMOs also joined in Mendaki’s efforts in uplifting the educational levels of the Malay/Muslim community. Prominent among these is the Lembaga Biasiswa Kenangan Maulid (Prophet Muhammad’s Birthday Memorial Scholarship Fund Board) that is funded by zakat contributions, public donations, grants and subsidies.

The success of Mendaki and the MMOs have led to the emergence of more Muslims with higher educational qualifications and income levels, more Muslim professionals in wider range of vocations including in legal and finance, and greater awareness and interest in Islamic financing within the community. In response, Islamic religious scholars in Singapore have sought to strengthen their expertise in Fiqh Muamalat and modules on Islamic finance has been included in the curriculum of Madrasahs. More recently two young Malay finance enthusiasts supported by Islamic finance professionals and Shariah experts established an Islamic Finance website (islamicfinance.sg) as a one-stop platform to provide resources, information and address any Islamic finance and investment-related needs of the Singapore Muslim community.

More details of the Islamic financial activities in Singapore over the years are provided in the sections below.

Governance of Islamic Financial Activities in Singapore

In accordance with the provisions in Singapore’s Constitution, the Administration of Muslim Law Act (AMLA) was enacted in 1966. It established the Majlis Ugama Islam Singapura (MUIS), a statutory body which oversees zakat, waqf, Islamic education, and adjudicates Muslim family and estate matters via the Shariah Court. However, MUIS does not regulate the financial asset classes or the NBFIs.

The supervision and regulation of all financial asset classes in Singapore are under the purview of the Monetary Authority of Singapore (MAS). The MAS also has a developmental function. One of its developmental initiatives was to enable the conduct of Islamic finance in order to attract the management of Middle Eastern wealth in Singapore. MAS’ positioning was that Singapore will not be a complete international financial centre if it does not also offer Islamic financial services. MAS has taken the approach of having no separate legislations or licensing requirements for Islamic financial activities in Singapore. MAS has determined that except for Shariah matters, the prudential and supervisory requirements for Islamic and conventional finance are largely the same. Shariah matters are part of the corporate governance of the financial players undertaking Islamic financial asset activities in Singapore. Except for banking, there are also no amendments required for the conduct of sukuk, Islamic funds and takaful activities. For banking, the Banking Regulations was amended to allow banks in Singapore to undertake non-banking activities as part of their Islamic financing transactions.

For the NBFIs, Islamic credit co-ops and pawnshops are governed by the Co-operative Societies Act and the Pawnbrokers Act, under the supervision of the Ministry of Culture, Community and Youth (MCCY) and Ministry of Law (MinLaw) respectively.

The approach in the governance of Islamic financial activity in Singapore illustrates how a secular, multiracial state with a Muslim minority can foster a functioning and innovative Islamic finance ecosystem. The community’s own agency, supported by a flexible yet rigorous regulatory framework, has enabled the development of Islamic asset class activities, social finance, and alternative financial institutions without requiring separate Islamic laws.

This experience offers a valuable blueprint not only for other Muslim minorities around the world, but also for Muslim-majority countries exploring adaptable and inclusive models of Islamic finance.

Governing Legislations & Supervisory Agencies for Islamic Financial Activities in Singapore

| Financial Activity/Entity | Governing Legislation | Supervisory Agency/Body | Parent Ministry |

| Islamic Banking | Banking Act & Banking Regulations |

Monetary Authority of Singapore (MAS) |

Prime Minister’s Office (PMO) |

| Sukuk | Securities & Futures Act | ||

| Takaful | Insurance Act | ||

| Islamic Funds | Securities & Futures Act | ||

| Islamic Credit Co-operatives | Co-operative Societies Act | Registry of Co-operatives | Ministry of Culture, Community and Youth (MCCY) |

| Ar Rahnu Pawnshops | Pawnbrokers Act | Registry of Pawnbrokers | Ministry of Law (MinLaw) |

| Zakat |

Administration of Muslim Law Act (AMLA) |

Majlis Ugama Islam Singapura (MUIS) |

Ministry of Culture, Community and Youth (MCCY) |

| Sadaqah | |||

| Waqf | |||

| Islamic Estate Matters |

Islamic Financial Activities in Singapore

A. By the Financial Asset Classes

Islamic Banking

Islamic banking in Singapore began in 1998 with the opening of an Islamic banking window facility by OCBC following discussions with the Singapore Malay Teachers Cooperative.

In 2007, DBS launched the Islamic Bank of Asia (IBA), in a joint venture with Middle Eastern investors. IBA focused exclusively on wholesale banking and did not offer domestic retail products. It ceased operations in 2015 due to scalability issues.

Presently various banks are providing Islamic banking in Singapore through window facilities. Maybank and CIMB offer both wholesale and retail Islamic banking. OCBC provides Islamic banking accounts. The Middle East banks (i.e. First Abu Dhabi Bank, Emirates NBD, Qatar National Bank, Saudi National Bank and Bank ABC) provides wholesale Islamic banking services. Banks such as Credit Agricole, HSBC and Standard Chartered participate in Islamic finance deals with their teams from either KL or Dubai.

Sukuk

MUIS issued Singapore’s first sukuk in 2001 to fund waqf property development. This S$25 million issuance was globally significant–it was the first sukuk to fund waqf assets and the first to use a Musharakah (partnership) structure. Follow-up issuances by MUIS included another Musharakah sukuk in 2002 and an Ijarah sukuk in 2009.

In 2009, MAS established its own Singapore dollar sukuk facility to provide rated assets for financial institutions conducting Islamic financial activities in Singapore to meet their regulatory requirements. The first conventional financial regulator to do so.

By 2014, 35 sukuk had been issued in Singapore–the most in any non-Muslim jurisdiction. Sukuk issued elsewhere are also listed on the Singapore Exchange. The most recent was the June 2024 Indonesian government issuances of a 5-year US$750m sukuk, a 10-year US$1b sukuk, and a 30-year US$600m sustainable sukuk.

Takaful

Takaful initiatives began in 1995 with two community-led ventures: Syarikat Takaful Singapura and AMPRO-NTUC Takaful. A rated retakaful company, Tokio Marine Retakaful, was licensed in 2004. However, all these efforts ceased operations over time.

Today, only two Takaful providers remain: United Overseas Insurance (UOI) offers general takaful via a window, while Maybank’s Etiqa launched an investment-linked takaful plan in January 2025.

Islamic Funds

The first Islamic fund in Singapore, Amanah Saham Mendaki (ASM) was launched in November 1991 by Malay-Muslim self-help group Mendaki. It was also the world’s first halal capital-guaranteed fund. Other Islamic funds followed. Some of the notable funds are

- Mendaki Global Fund (1997) – A follow-up investment product by Mendaki managed by DBS.

- Securus Data Property Fund (2010) – The world’s first Shariah-compliant property fund focused on data centres..

- Sabana Shariah Compliant REIT (2010) – The largest Islamic REIT by assets globally when launched and the first to be listed on SGX. In 2012, the REIT established a sukuk programme in Singapore to finance its operations. However, in 2021 the REIT ceased to be Shariah compliant.

- Lion-BIBDS Islamic Enhanced Liquidity Fund (2024) – first Islamic mutual fund managed in Brunei and first Shariah-compliant enhanced liquidity fund domiciled in Singapore.

B. By the Non-Bank Financial Institutions (NBFIs)

Islamic Credit Cooperatives (Co-ops)

Mendaki launched Ufuk Co-op as Singapore’s first Islamic credit co-op in 1999. However Ufuk eventually liquidated due to sustainability challenges. Presently four of the 22 credit co-ops in Singapore are linked to Muslim groups. They include the Singapore Muslim Teachers’ Co-operative and the Kadayanallur Muslim Co-op (catering to the Indian Muslim community). The Muslim Teachers’ Co-op had played pioneering roles in setting up the first Takaful company (in 1995) and the first Islamic banking window (in 1998) in Singapore.

Ar Rahnu Pawnshops

Ar Rahnu pawnshops provide loans based on Islamic principles and secured against valuables. As of May 2025, three Ar Rahnu outlets operate in Singapore out of 242 licensed pawnshops. Singapore’s first Ar Rahnu operator, 916 Pawnshop, is still active in Tampines. In 2020, ValueMax, a pawnshop chain, launched its first Ar Rahnu branch at Joo Chiat Complex, followed soon after by another branch at Haig Road.

Central Provident Fund (CPF)

The CPF, Singapore’s compulsory retirement savings scheme, plays a unique role in the country’s Islamic financial activities. With 37.6 per cent of Muslims now over the age of 55 years, their CPF withdrawals have contributed to growing Islamic deposits and charitable donations. MUIS has issued three fatwas with regards to the CPF balances[2]. Most importantly, the interest on the CPF balances is not riba as it is not derived from any borrowing or lending activities by the CPF. Instead, the CPF states upfront on the interest it will pay on CPF balances for the year. Hence it should be considered as a gift (hiba) from the government.

In 2022, CPF balances totalled S$544.8 billion (US$422 billion) – nearly double the assets of the largest Islamic bank, Al Rajhi. Viewed through an Islamic finance lens, CPF could be considered the world’s largest de facto Islamic NBFI.

C. Islamic Social Finance

Zakat

Zakat administration in Singapore faced early challenges due to limited data and low incomes. However, the zakat amounts collected annually have grown steadily over the years due to rising income levels, greater awareness on calculation of zakat on wealth and the provision of more channels for payment of zakat. Starting from just S$393,415 in 1968[3], zakat collections have grown significantly, reaching S$72.7 million in 2024[4].

Sadaqah

The four identified groups of recipients for sadaqah in Singapore are: i) the Mosque Building Fund; ii) mosques and madrasahs; iii) Malay-Muslim organisations; and iv) charitable causes overseas.

i) Mosque Building Fund

Singapore’s Mosque Building Fund (MBF), proposed by former PM Lee Kuan Yew, is an innovative CPF-linked deduction program that enabled Muslim workers to provide monthly contributions for mosque construction. It is voluntary in nature as workers can opt out from having their salaries deducted. However reportedly none had done so since the programme started in 1975. The annual gross contributions collected through CPF has grown from S$421,203 in 1975[5] to S$48.9 million in 2024. By end December 2024, MBF’s accumulated funds had reached S$230.6 million[6]. As at 2024, the Fund had financed the building of 26 new large mosques and the upgrading of the earlier mosques built.

ii) Mosques and madrasahs

Sadaqah to mosques are directly inserted in the collection chests or credited on-line to the mosque’s bank account. The amounts of donations collected are declared in the mosques’ audited financial statements posted on their noticeboards. Based on a small sampling of mosques’ financial statements, it is roughly estimated that the 70 mosques in Singapore are receiving a total of about S$105m in sadaqah annually.

The financial statements for each of the 6 madrasahs under MUIS are not publicly available. However MUIS’ Annual Report does state the total public donations received by the madrasahs for the year. In 2024 the madrasahs received a total of S$1.4 million in public donations, just a slight increase from the S$1.1 million in public donations the madrasahs received in 2011[7].

iii) Malay-Muslim Organisations (MMOs)

Based on their available financial statements, in the last five years the amount of sadaqah or voluntary donations to 11 MMOs has risen from S$42.2m in 2020 to about S$57.3m in 2024.[8] The amount for 2024 is still understated as the 2024 annual reports for 3 of the MMOs are not yet available. These amounts include those raised through fund-raising efforts and do not include grants and subsidies from MUIS, government bodies and non-Muslim charitable organisations, and income from income generating activities such as rental of their premises for activities and from the investments of their past savings.

iv) Charitable causes overseas

This is an observable trend but is impossible to quantify. These are sadaqah to humanitarian aid overseas as well as for contributions to waqf and Qurban for Muslim communities in need overseas. Appeals for contributions and collection of funds are usually done on line and social media with no scope for independent verification of their authenticity and records of the funds collected and the manner they are finally used.

Waqf

Waqf is the oldest form of Islamic financial activity in Singapore, beginning with a waqf in 1820 for the building of a mosque. MUIS introduced multiple innovations in their administration of waqfs in Singapore:

- Asset migration (Istibadal) since 1985 to repurpose underperforming waqf lands.

- A 1995 amendment to AMLA requiring all waqfs in Singapore to register with MUIS.

- Sukuk issuances in 2001, 2002 and 2009 to finance development of waqf properties.

- Establishment of Warees Investments in 2001 to focus on the commercial development of waqf properties.

MUIS press statements indicated that proceeds from MUIS-managed waqfs amounted to S$4.9m in 2020, S$4.0m in 2021 and S$4.1m in 2022. About 70% of the proceeds were disbursed locally to mosques, madrasahs, Muslim organisations and the poor and needy. The remaining 30% are allocated to beneficiaries in the waqif’s country of origin.

With no new property-based waqfs being established in Singapore since 1978, there has been several initiatives in recent years to set-up cash-based waqfs. These waqfs provide opportunities for the Singapore Muslim community to undertake Sadaqah Jariyah or long term ongoing charity through cash contributions. MUIS launched their Waqf Ilmu in 2012 and Waqf Masyarakat Singapura in 2024. Several mosques have initiated their own cash waqf initiatives to finance their renovations and upgrading projects. These include Masjid Haji Md Salleh & Maqam Habib Noh, Masjid Hasanah, Masjid Sallim Mattar, Masjid ArRaudhah, and Masjid Al-Islah.

Estate Planning

The Singapore Syariah Court provides a free on-line trial inheritance calculator on its website to allow users to determine the eligible beneficiaries for the Faraid distribution of their estate.

In 2022 the Singapore Academy of Law published a monograph on Muslim Family Law in Singapore as a one-stop reference for lawyers undertaking Muslim divorce and estate distribution cases at the Syariah Court.

In recent years, several trends are converging to heighten interest in estate planning in a Shariah compliant manner among Muslims in Singapore. For the younger generations that are now more educated and with higher incomes, their interests are in building up their savings and managing risks associated with unexpected adverse developments to their health or income earning capabilities. For Muslims in their senior and retirement years, their interest is ensuring their estate is distributed to their intended beneficiaries and to prepare for their passing. Hence, there is significant interest in Lasting Power of Attorney (LPA), wassiyah, hibah, nominations for their insurance/takaful policies and CPF balances, rightful beneficiaries under Faraid and donating via zakat, voluntary charity (sadaqah and infaq), ongoing charity (sadaqah jariyah) and waqf.

Conclusion

The Islamic finance ecosystem in Singapore may appear small on the surface, but it mirrors the structure of an iceberg: much of its scale and volume lies beneath the waters. Beyond headline-grabbing sukuk issuances or launches of Islamic banking products, a complex and dynamic network of financial asset classes, social finance, and non-bank institutions has emerged–driven by community initiative and supported by regulatory flexibility.

Singapore’s experience offers a compelling model for other Muslim minority communities and even Muslim-majority nations exploring inclusive, adaptable approaches to Islamic finance.

Annex 1: Overview of Finance in Islam

Annex 2: Profile of Muslim Community in Singapore

A. Muslims in Singapore – By Ethnicity 1980

| Total | % Chinese | % Malay | % Indians | % Others | |

| Total | 1,981,962 | 76.6 | 14.8 | 6.4 | 2.1 |

| Muslims (% of Total) | 323,866 (16.3%) | 0.3 | 90.2 | 8.6 | 0.8 |

Source: Computed from Census of Population Singapore 1980, Release No. 9, Religion and Fertility, Singapore Department of Statistics, 1981

2020

| Total | % Chinese | % Malay | % Indians | & Others | |

| Total | 3,459,093 | 75.4 | 12.9 | 8.6 | 3.0 |

| Muslims (% of Total) | 539,251 (15.6%) | 2.2 | 82.0 | 13.0 | 2.8 |

Source: Computed from Census of Population Singapore 2020 Statistical Release 1: Demographics, Education, Language and Religion, Singapore Department of Statistics, June 2021.

B. Muslims in Singapore – By Age Group 1980

| Age Group(%) | ||||||||

| 10-19 | 20-29 | 30-39 | 40-49 | 50-59 | 60-69 | 70+ | Total | |

| Muslims | 31.5 | 28.2 | 14.2 | 11.3 | 9.0 | 4.2 | 1.7 | 100 |

| Total Population | 26.3 | 27.5 | 17.3 | 12.0 | 8.3 | 5.5 | 3.1 | 100 |

Source: Computed from Census of Population Singapore 1980, Release No. 9, Religion and Fertility, Singapore Department of Statistics, 1981

2020

| Age Group(%) | ||||||||

| 15-19 | 20-29 | 30-39 | 40-49 | 50-59 | 60-69 | 70+ | Total | |

| Muslims | 8.6 | 20.5 | 19.0 | 14.3 | 17.4 | 13.0 | 7.2 | 100 |

| Total Population | 6.3 | 15.3 | 17.3 | 17.6 | 17.4 | 14.9 | 11.3 | 100 |

Source: Computed from Census of Population Singapore 2020 Statistical Release 1: Demographics, Education, Language and Religion, Singapore Department of Statistics, June 2021.

C. Muslims in Singapore – By Highest Qualifications Attained 1980

| Total | Full time students | Primary and below | Secondary & Upper Secondary | Tertiary | |

| Muslims | 100.0 | 18.1 | 70.0 | 11.1 | 0.4 |

| Total Population | 100.0 | 17.3 | 65.1 | 15.3 | 2.3 |

Source: Computed from Census of Population Singapore 1980, Release No. 9, Religion and Fertility, Singapore Department of Statistics, 1981

2020

| Total | No Qualifications | Primary | Lower Secondary | Secondary | Post secondary (non-tertiary) | Polytechnic Diploma | Professional Qualification & Other Diploma | Tertiary | |

| Muslims | 100.0 | 9.8 | 7.0 | 9.7 | 22.6 | 19.9 | 12.6 | 6.1 | 12.2 |

| Total

Population |

100.0 | 10.6 | 5.5 | 8.2 | 16.1 | 10.9 | 9.6 | 6.9 | 32.1 |

Source: Computed from Census of Population Singapore 2020 Statistical Release 1: Demographics, Education, Language and Religion, Singapore Department of Statistics, June 2021.

References

- Dr Ahmad Ibrahim, Islamic Law in Malaya, Malaysian Sociological Research Institute Ltd, Singapore, 1965

- Ahmad Nizam Abbas, Istyana Putri Ibrahim & Maryam Hasanah Rozlan, Muslim Family Law in Singapore, SAL Academy Publishing, Singapore, 2022

- Anthony Green, Continuing the Legacy: 30 Years of the Mosque Building Fund in Singapore, Majlis Ugama Islam Singapura (MUIS), Singapore, 2007

- Anthony Green, Honouring the Past Shaping the Future – The MUIS Story: 40 years of Building a Singapore Muslim Community of Excellence, Majlis Ugama Islam Singapura (MUIS), Singapore, 2009

- Amina Tyabji, “The Management of Muslim Funds in Singapore”, Chapter 9 in Mohamed Ariff (Ed), The Islamic Voluntary Sector in Southeast Asia, Special Issues in Southeast Asia, Institute of Southeast Asian Studies, Singapore, 1986.

- Cyril Glasse, The Concise Encyclopedia of Islam, Revised Edition, Singapore 2001

- Farishta G, de Zayas, The Law and Institution of Zakat, The Other Press, Kuala Lumpur, First Reprint 2008

- Ibrahim Tahir (Ed), Hand to Heart – The Collective Spirit of Malay/Muslim Organisations in Singapore, Singapore, 2016.

- Kevin YL Tan and Thio Li-Ann, Singapore – 50 Constitutional Moments that Defined a Nation, National Archives of Singapore, Marshall Cavendish edition, 2015.

- Munawar Iqbal and Philip Molyneux, Thirty Years of Islamic Banking – History, Performance and Prospects, Palgrave Macmillan, New York, 2005

- Shamsiah Abdul Karim, Contemporary Waqf Administration and Development in Singapore: Challenges and Prospects, MUIS, 2006

- Syed Isa Semait, Keeping the Faith, MUIS, Straits Times Press, Singapore, 2012

[1] This article is an abridged version of an unpublished paper by the author, a retired Deputy Director of the Monetary Authority of Singapore.

[2] The 3 fatwas by MUIS with regards to CPF balances (found on the MUIS website) are (a) interest on CPF balances are not riba but a gift (hiba) from the government, (b) Nominations by CPF account holders during their life time are hiba by the account holder to the nominated beneficiaries of their CPF accounts and the amounts are not to be included in the estate to be distributed by Faraid, and (c) the appropriate manner to calculate the zakat on wealth payable on the CPF balances that can be withdrawn by the CPF account holder.

[3] Amina Tyabji, “The Management of Muslim Funds in Singapore”, Chapter 9 in Mohamed Ariff (Ed), The Islamic Voluntary Sector in Southeast Asia, Special Issues in Southeast Asia, Institute of Southeast Asian Studies, Singapore, 1986.

[4] MUIS Annual Report 2024.

[5] MUIS, Continuing the Legacy: 30 Years of the Mosque Building Fund in Singapore, 2007.

[6] MUIS Annual Report 2024.

[7] MUIS Annual Reports 2024 and 2012.

[8] The 11 MMOs are Ain Society, Association of Muslim Professionals (AMP), Darul Arqam, Jamiyah Society, Lembaga Biasiswa Kenangan Maulid (LBKM), Muhammadiyah (Welfare Home and Health & Day Care Centre), Muslim Kidney Action Association (MKAC), Persatuan Ulama dan Guru-guru Islam Singapura (Pergas), Pertapis, Tabung Amal Aidil Fitri Trust Fund (TAA), and Yayasan Mendaki.