Islamic Financial Activities in Singapore: Context and Developments in a Secular Country with a Muslim Minority Community

Discussions on Islamic finance often focus on the financial asset classes of Islamic banking, Islamic bonds (sukuk), Islamic funds, and Islamic insurance (takaful), especially in Muslim majority countries such as Malaysia and the Gulf Cooperation Council (GCC) nations – Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the UAE.

However, Islamic financial activities are also conducted by non-bank financial institutions. Further, finance in Islam goes beyond commercial transactions – almsgiving (zakat), for instance, is one of the five pillars of Islam and emphasizes the moral use of wealth to aid the needy and benefit society.

Beginner-Friendly tools for Shariah-Compliant Stock Investing (2025/26 Edition)

Halal investing is now more accessible than ever. This guide walks you through a practical workflow for building a Shariah-compliant stock portfolio, beginning with screening through RizqX and followed by deeper financial analysis using TYKR or Sterling Stock Picker. Whether you are new to the market or refining your strategy, this article simplifies the process and equips you with tools to invest confidently and ethically.

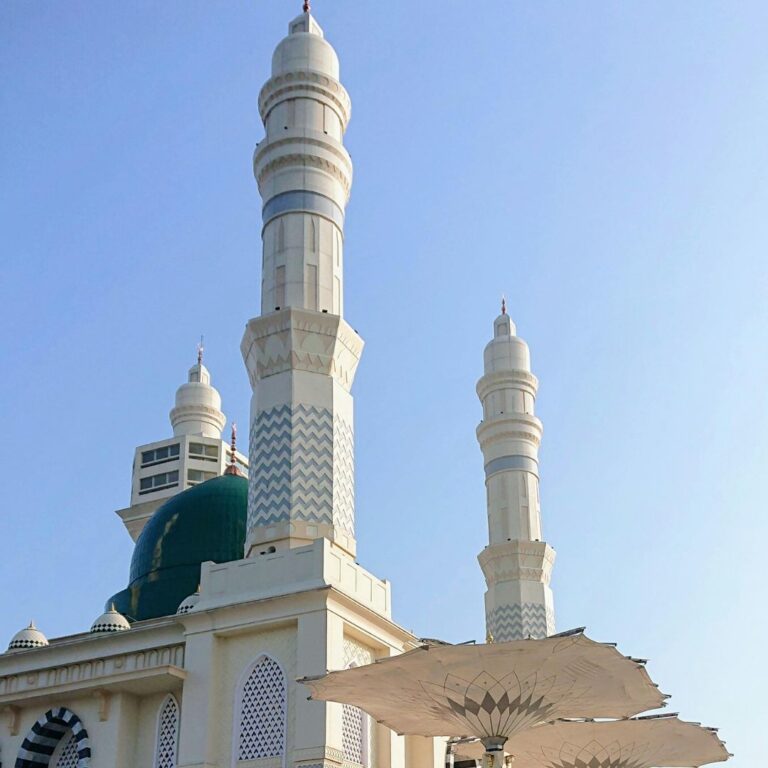

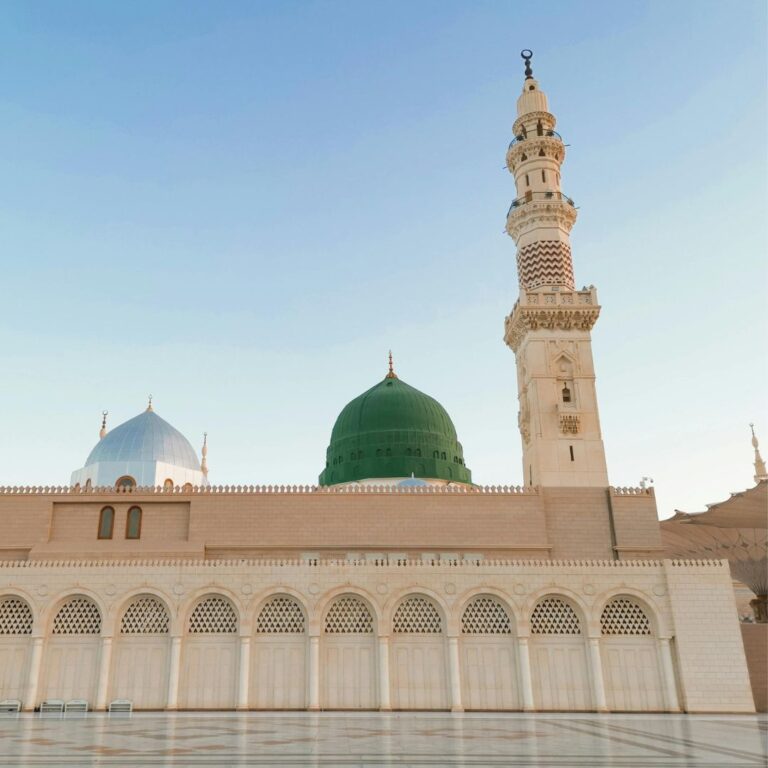

Turaths & Todays: Muamalat Essentials (Class #12)

Turaths & Todays: Muamalat Essentials (Class #12, Summary of the class) QnA before entering the session. Question: Is working in

Turaths & Todays: Muamalat Essentials (Class #11)

Turaths & Todays: Muamalat Essentials (Class #11, Summary of the class) Regarding Sharikah and Modern Business Entities A public company,

Turaths & Todays: Muamalat Essentials (Class #10)

Turaths & Todays: Muamalat Essentials (Class #10, Summary of the class) Shirkah (الشركة) Question: Some people are making marketing videos

Turaths & Todays: Muamalat Essentials (Class #9)

Turaths & Todays: Muamalat Essentials (Class #9, Summary of the class) Hajr (الحجر) Definition of Hajr Linguistically, al-hajr refers to

Turaths & Todays: Takaful Guest Class (Class #8)

Turaths & Todays: Takaful Guest Class (Class #8, Summary of the class) Takaful (تكافل) What Are You Most Curious to

Turaths & Todays: Muamalah Essentials (Class #7)

Turaths & Todays: Muamalat Essentials (Class #7, Summary of the class) Qardh (القرض) From Kitab Al-Yaqut An-Nafis fii Madzhab ibn Idris:

Your Guide to Islamic Financing in Singapore

In finance, the term Shariah-compliant refers to products or services that follow ethical rules derived from Islamic principles. A simple way to understand this is by thinking about Halal in food. Just as Halal labels indicate that food is prepared in a special manner, Shariah compliance signals that a financial product upholds certain standards.

Turaths & Todays: Muamalat Essentials (Class #6)

Turaths & Todays: Muamalat Essentials (Class #6, Summary of the class) Ba’i Salam (بيع السّلم) Definition and Linguistic Meaning The

Turaths & Todays: Muamalat Essentials (Class #5)

Turaths & Todays: Muamalat Essentials (Class #5, Summary of the class) Riba (الربا) In this session, we will revisit the

Turaths & Todays: Zakat in Practice (Class #4)

Turaths & Todays: Zakat in Practice (Class #4, Summary of the class) What is Zakat? Literally, Zakat means purification. In

Breaking the mold: How Singapore could pioneer global Islamic digital finance

Breaking the mold: How Singapore could pioneer global Islamic digital finance 9th July 2025 Singapore’s position as Asia’s financial hub

Singapore High Income and Low Volatility Model Portfolio Methodology

Singapore High Income and Low Volatility Model Portfolio Methodology July 2025

Turaths & Todays: Ba’i and Riba (Class #3)

Turaths & Todays: Ba’i and Riba (Class #3, Summary of the class) Introduction This lesson focuses on the topics of

Turaths & Todays: Muamalat Essentials (Summary of Class #2)

This session explores key concepts in Islamic finance including the nature of Haqq (rights), classifications of Maal (wealth), the objectives of Maqasid Shariah, and the foundational principles of Ba’i (sales) and contracts. Through classical definitions and contemporary examples like crypto, NFTs, and online payments, students gain a deeper understanding of how Shariah governs financial transactions in both traditional and modern contexts.

Bridging Values: Integrating Values-based Investing with Islamic Wealth Management

TLDR (summary) Values–based investing aligns financial growth with purposeful values, emphasising positive social and environmental impact alongside profit. Islamic Wealth

Shared Responsibility, Mutual Benefit: Discover Takaful with Maybank Islamic Wealth Management and Etiqa

Discover how Takaful, offered by Maybank Singapore’s Islamic Wealth Management and Etiqa Singapore, combines shared responsibility, purposeful investments, and comprehensive financial protection. Learn how this values-driven solution safeguards your future while promoting societal well-being.

Enhancing Returns with Islamic Structured Deposits

Discover the essentials of Islamic Structured Deposits, their principled investment framework, and how they can offer a balance of capital protection and potential for enhanced returns.

Maximising Wealth With Islamic Dual Currency Investment

Explore how Islamic Dual Currency Investments (IDCIs) provide a Shariah-compliant pathway for optimising returns while diversifying your portfolio. Learn how Maybank’s Islamic Wealth Management solutions can help you achieve your financial goals through tailored advisory and innovative investment options.

Notes from Turaths & Todays : Muamalat Essentials Class #1

In our first session of Muamalat Essentials, we explored the Islamic perspective on wealth, the objectives of Shariah (Maqasid al-Shariah), and the evolution of economic systems. We discussed how Islam encourages wealth accumulation as a means of strengthening the Ummah, while also setting ethical boundaries to prevent harm.

Umdatus Salik #12 – Prohibited Kinds of Transactions Part IV: Contracts & Defective Returns

Prohibited Kinds of Transactions Part IV: Contracts & Defective Returns Introduction The validity and ethical considerations of any kind of

Umdatus Salik #11 – Prohibited Transactions Part III

Prohibited Kinds of Transactions Part III Introduction Part III continues from the previous article, “Some Prohibited Kinds of Transactions Part

Umdatus Salik #10 – Some Prohibited Kinds of Transactions Part II: Either-or Sales, Sales with Extraneous Stipulations, Sales with Valid Stipulations, Paying Nonrefundable Deposits

#10 Some Prohibited Kinds of Transactions Part II: Either-or Sales, Sales with Extraneous Stipulations, Sales with Valid Stipulations, Paying Nonrefundable