Singapore High Income and Low Volatility Model Portfolio Methodology

July 2025

Summary

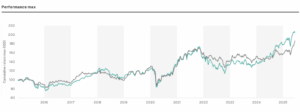

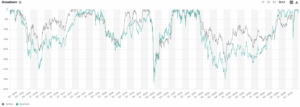

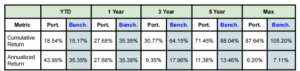

The Portfolio Singapore Low Volatility and High Dividend strategy has generated a total return of 88% since its backtest date on 2015-01-02, with an annualized return of 6.20%. The portfolio’s volatility is 12.93%, and it has a Sharpe Ratio of 0.48. As of 2025-06-18, the portfolio consists of 37 holdings, with a tilt towards value and away from growth stocks. The largest sector allocation is in Finance (57%), followed by Transportation (10%). The portfolio’s primary objective is to minimize risk, which is reflected in its configuration, which includes constraints on stock weight, net exposure, and sector/country weights relative to the benchmark (S&P Singapore BMI). A target dividend yield of at least 6% is also in place. The portfolio has constraints on both tracking error vs benchmark and implied beta.

Portfolio Overview

- Portfolio Name: SGP Low Volatility and High Dividend Portfolio

- Benchmark: S&P Singapore BMI

- Currency: SGD

- Inception Date: 1st July 2025

- Backtest date: 2015-01-02

- Number of Holdings: 37

- Dividend Yield: 9.82% (Benchmark Dividend Yield: 4.25%)

Investment Objective and Strategy

The portfolio’s investment objective is to achieve the lowest possible volatility while investing exclusively in Singaporean stocks. The strategy employs a quantitative approach, leveraging AI signals and factor exposures to construct a portfolio that adheres to Shariah compliance. The investment universe is rebalanced quarterly, selecting stocks excluding the bottom 1.5% according to the AI signal, within the Singapore region, that adhere to the S&P Shariah rulebook.

S&P Shariah Screening Methodology

Reference: S&P Shariah Indices Methodology

To ensure that the portfolio adheres to Islamic principles, the investment universe is filtered using the S&P Shariah screening process, which is conducted by its partner, Ratings Intelligence. This process involves two main levels of screening: Business Screening and Financial Screening.

1. Business Activity Screening (Sector-Based)

First, companies are screened based on their primary business activities. Companies with significant involvement in the following sectors are excluded from the investment universe:

- Advertising (Advertisers of Pork, Alcohol, Tobacco, Gambling, and all other non-Islamic Activities)

- Alcohol

- Gambling

- Pork-related Products

- Conventional Financial Services: Including conventional banking and insurance.

- Tobacco and electronic cigarettes/vaping products

- Media & Entertainment: Specific areas such as the production of music, movies, and television shows.

- Pornography

- Recreational Cannabis

- Trading of gold and silver as cash on deferred basis

A revenue tolerance is applied, where a company may still be considered compliant if its total income from these non-permissible business activities is less than 5% of its total revenue.

2. Financial Screening (Accounting-Based)

After passing the business activity screen, companies are then examined based on their financial ratios to ensure they meet Shariah principles regarding finance. The key financial screen is a leverage test:

- Leverage Compliance: The company’s total debt relative to its market value is assessed. The ratio of Debt to the 36-month average Market Value of Equity must be less than 33%.

This two-tiered screening process ensures that the companies selected for the portfolio are compliant with the core principles of Islamic finance from both a business operations and a financial health perspective.

AI Dragon Portfolio Construction Constraints

To build the Singapore Low Volatility and High Income portfolio, our AI Dragon engine operates within a specific set of rules. These constraints guide every investment decision to ensure the portfolio consistently meets its objectives.

Core Portfolio Rules

- Investment Universe: The portfolio invests exclusively in Shariah-compliant companies listed in Singapore, as defined by the S&P Singapore BMI index.

- AI Signal Filter: The AI engine automatically excludes the bottom 1.5% of stocks based on its proprietary signal, aiming to avoid potential underperformers.

- Diversification: To manage risk, the portfolio’s weight in any single industry sector is not allowed to deviate from the benchmark’s weight by more than 5%.

- Income Target: The portfolio is built to target a minimum dividend yield of 6%, directly addressing the “High Income” objective.

- Factor Tilts: The engine is explicitly instructed to overweight stocks with high dividend yields and underweight stocks with high, unpredictable price swings (residual volatility).

Rationale for the Volatility Filters

The primary goal of this portfolio is to provide stable returns with less risk than the overall market. To achieve this “Low Volatility” objective, we employ a multi-layered risk management approach using specific volatility filters:

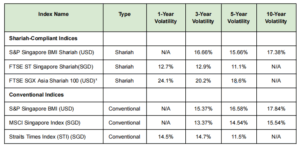

1.Overall Risk Cap (Limit Volatility <= 13%): This is the portfolio’s primary risk control. We establish a firm ceiling on the portfolio’s total expected risk at 13% (annualized). This figure is a strategic decision derived from a thorough analysis of relevant market benchmarks.

- Benchmark Volatility Analysis: The average 5-year annualized volatility for conventional Singapore-focused benchmarks (S&P Singapore BMI, MSCI Singapore Index, and STI) is approximately 14.2%. The average for the Shariah-compliant peer group is 13.4%.

- Justification: By capping the portfolio’s volatility at 13%, we are explicitly targeting a risk level that is approximately 9% lower ((14.2-13)/14.2), than the conventional market average. This ensures the portfolio maintains a consistently risk-managed profile compared to the broader market, which is fundamental to its “Low Volatility” objective. This constraint is designed to mitigate the magnitude of drawdowns during market declines and provide a more stable investment experience for the risk-conscious, income-focused investor.

2. Managing Market Sensitivity (Limit Beta <= 0.99): Beta measures the portfolio’s sensitivity to overall market movements. By capping the beta at 0.99, we are engineering the portfolio to be less volatile than its benchmark. In practice, this means it is structured to capture less of the market’s downside during periods of decline, contributing to a more stable investment journey.

3. Ensuring Benchmark Cohesion (Limit Tracking Error <= 1.5%): While managing risk is critical, the portfolio’s performance should not become completely disconnected from the Singaporean market. This rule ensures that the portfolio’s returns do not deviate excessively from its benchmark. This adds a layer of predictability and prevents the strategy from taking on unintended risks.

By combining these precise volatility constraints with a strict dividend target, the AlDragon engine systematically constructs a portfolio that is risk-controlled, income-focused, and aligned with the strategy’s core objectives.

Volatility Benchmark Comparison

The table provides a comparison of the annualized volatility (standard deviation) for key Shariah-compliant and conventional Singapore-focused equity indices, based on the indexes factsheets. Volatility is a measure of risk, indicating the degree of variation in an index’s returns over time.

Data extracted from S&P, FTSE Russell, and MSCI factsheets dated between May 30, 2025, and June 30, 2025. ¹Note: The FTSE SGX Asia Shariah 100 Index is an Asia-Pacific regional index, not exclusively focused on Singapore, and is included for broader context.

Performance Analysis (Key Financial Metrics):

The table below shows the portfolio’s performance analysis as of 18/06/2025:

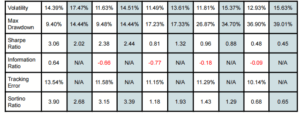

Portfolio Performance Analysis (Other Metrics):

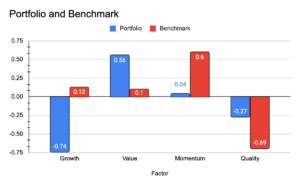

Factor Exposure:

This chart compares the portfolio’s exposure to key investment “factors” against its benchmark. Factors are broad, persistent drivers of returns. The chart shows that the portfolio has a strong negative tilt away from ‘Growth’ stocks (-0.74) and a significant positive tilt towards ‘Value’ stocks (0.56), which aligns with the strategy’s objective of seeking stable, high-dividend-yielding companies rather than high-growth stocks.

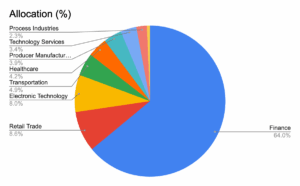

Sector and Country Composition:

The portfolio is exclusively invested in Singapore (100%). The pie chart below illustrates the portfolio’s allocation across different industry sectors. A significant concentration in the Finance sector (64.0%) is evident, indicating that a majority of the portfolio’s holdings are in financial services companies, which are often a source of stable dividend income.

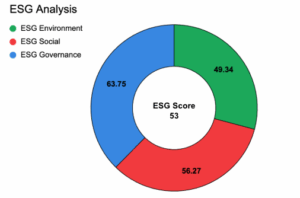

ESG Analysis:

This chart breaks down the portfolio’s overall ESG (Environmental, Social, and Governance) score. With a total score of 53, the portfolio shows a balanced approach to sustainability. The highest score is in Governance (63.75), suggesting the underlying companies have strong corporate governance standards, which is often correlated with lower risk and long-term stability.

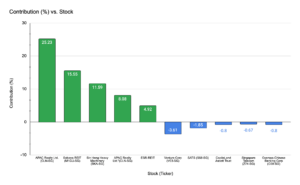

Top Contributors and Detractors:

This chart pinpoints the individual stocks that have had the most significant impact on the portfolio’s performance. The strong performance of contributors like APAC Realty and SinHeng Heavy Machinery can be attributed to a robust construction and real estate market in Singapore during the period. Sabana REIT’s positive contribution was likely fueled by ongoing merger and acquisition discussions, which created significant investor interest. Conversely, detractors like Venture Corp and SATS faced headwinds in the global electronics and aviation sectors, respectively, which impacted their performance. This analysis is crucial for understanding which specific holdings and broader market trends are driving the strategy’s success or underperformance.

Risks

While this portfolio is designed for lower volatility and income generation, investors should be aware of the following key risks:

1. Concentration Risk: The portfolio is 100% invested in Singapore and heavily allocated to the Finance sector (64%). This concentration makes it particularly sensitive to Singapore-specific economic events and developments within the financial industry.

2. Style and Factor Risk: The strategy’s deliberate focus on ‘Value’ and ‘High Dividend Yield’ factors can lead to periods of underperformance, particularly in markets where ‘Growth’ stocks are strongly favored. Because these investment factors are cyclical, the portfolio may lag the broader market. This is compounded by the AI engine’s explicit negative exposure to growth, which indicates that the strategy may miss out on significant gains from growth-oriented companies.

3. Liquidity Risk: The portfolio may hold securities that are less frequently traded (less liquid) than those in the broader market. This presents a risk to the portfolio’s overall value. During periods of market stress or when the portfolio needs to be rebalanced, the AI Dragon engine may find it difficult to sell these underlying assets quickly without accepting a lowerprice. This can negatively impact the portfolio’s Net Asset Value (NAV), which in turn affects the value of the investment.

Conclusion

The RizqX Singapore Low Volatility and High Dividend Portfolio provides a specialized investment solution, meticulously designed for Shariah-conscious investors who prioritize capital preservation and consistent income.

The strategy’s disciplined, quantitative approach—which integrates AI-driven stock selection with stringent Shariah screening and data-driven risk controls—has historically resulted in lower volatility and smaller drawdowns. Importantly, as the performance chart illustrates, this risk-managed profile has successfully delivered competitive returns that have closely tracked the conventional benchmark, even with the deliberate trade-off against higher-growth strategies.

This balanced approach makes the portfolio a compelling option for investors whose primary goals are Shariah-compliant income generation and a more stable, yet competitive, investment experience within the Singaporean market.