Turaths & Todays: Muamalat Essentials

(Class #6, Summary of the class)

Ba’i Salam (بيع السّلم)

Definition and Linguistic Meaning

- The term As-Salam (or Salaf) in Arabic linguistically conveys the meanings of:

- Al-Isti’jal – hastening or advancing

- At-Taqdim – bringing something forward or sending ahead

- In Islamic jurisprudence, As-Salam refers to:

A type of sale contract where the buyer pays in advance for a specified item that will be delivered at a future date, using the terms “Salam” or “Salaf” or their equivalents.

How Salam Differs from Traditional Sales

- Traditional sales involve the exchange of goods or payment during the same session (majlis al-‘aqd).

- In Salam, however:

- The price is paid upfront by the buyer

- The goods are delivered later by the seller, with all specifications clearly defined and agreed upon at the time of contract

- One party (the buyer) gives full payment, but the other party (the seller) delays delivery

Historical Background

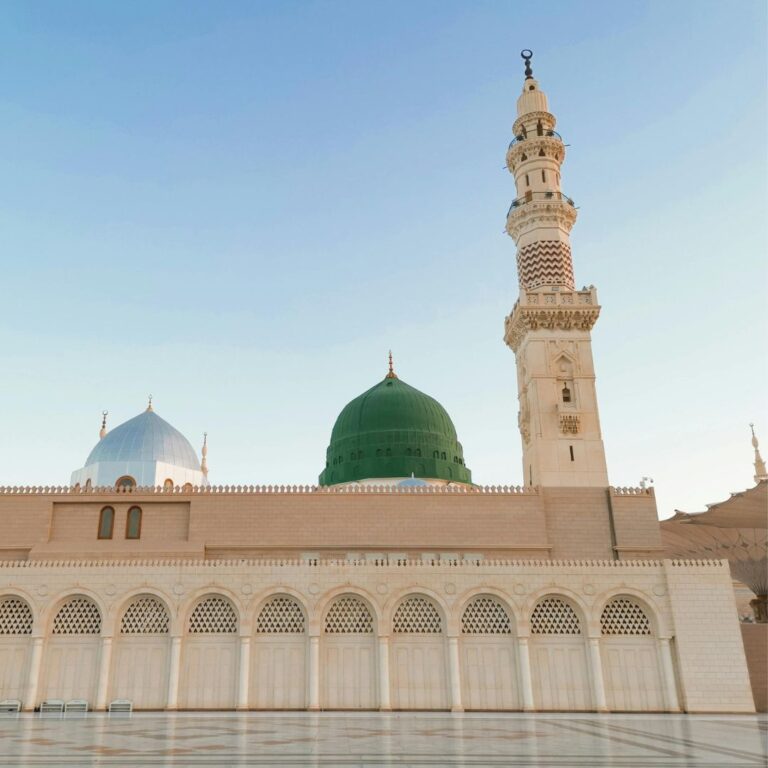

- In Makkah, during the Prophet’s ﷺ early life, most transactions involved immediate exchange of goods.

- When the Prophet ﷺ migrated to Madinah, he observed the practice of deferred delivery sales, where payment was made upfront, and goods were delivered one or two years later.

- Recognizing the people’s needs and the common use of this contract, the Prophet ﷺ permitted and regulated such transactions — provided the item was clearly specified.

Scriptural Basis

- The permissibility of Salam contracts is inferred from Surah al-Baqarah, particularly the verse:

يٰٓاَيُّهَا الَّذِيْنَ اٰمَنُوْٓا اِذَا تَدَايَنْتُمْ بِدَيْنٍ اِلٰٓى اَجَلٍ مُّسَمًّى فَاكْتُبُوْهُۗ وَلْيَكْتُبْ بَّيْنَكُمْ كَاتِبٌۢ بِالْعَدْلِۖ

“O believers! When you contract a loan for a fixed period of time, commit it to writing. Let the scribe maintain justice between the parties.”[1]

This indicates the acceptability of deferred contracts, provided they are accompanied by proper documentation.

Essential Elements or Constituents (Arkan) of a Salam Contract

- Buyer or Muslim (المسلم) – the buyer who pays in advance

- Seller or Muslam Ilayhi(المسلم إليه) – the one who commits to deliver the goods later

- Item Ordered or Muslam fiihi (المسلم فيه)– must be clearly specified in terms of type, quality, quantity, and delivery date

- Capital or Ra’sul Maal (رأس المال)– full payment made in advance at the time of the contract

- Contract Procedure or Shiighah (صيغة)– the agreement must include mutual consent and comply with Shariah rules

Six Additional Conditions for the Validity of a Salam Contract (besides the general rules of trade):

- Immediate Payment Must Be Made

- The price (money) must be fully paid at the time of the contract. Deferred payment is not allowed in Salam.

- Payment Must Be Handed Over During the Contract Session

- The payment must be delivered during the same session (in the same sitting) as the contract is agreed.

- It must be a clear and complete exchange (offer and acceptance with payment).

- Place of Delivery Must Be Specified

- The location where the goods will be delivered must be clearly defined.

- If the contract is to be executed in an unsuitable setting for delivery, a suitable alternative location must be agreed upon.

- Even if the delivery is deferred, the time and place must be known and appropriate.

- Seller Must Have the Ability to Deliver the Goods on Time

- The seller must have the capability to fulfil the order when it’s due.

- If delivery is uncertain or beyond the seller’s reasonable ability, the contract is invalid.

- Both Parties Must Fully Understand the Specifications of the Goods

- The detailed specifications of the item must be clearly understood by both the buyer and the seller.

- Having witnesses who also understand the item is recommended, but not required.

- The Description Must Be in a Clearly Understood Language

- The item’s description must be expressed in a language that both parties (and any witnesses, if present) can clearly understand.

- This is to avoid any misunderstanding and preserve the integrity of the contract.

Example of a Historical Salam Contract

Note: This example reflects a historical context. Slavery is strictly prohibited and has no place in modern law or ethics. This is shared solely for educational purposes, providing insight into the classical Islamic contract structure.

Zaid says to Amru:

“I place an order with you for a black male slave, aged five years, with a height of five palms (approximately 38.1 cm), for a price of 100 Dinars. You shall deliver the slave to me at the beginning of the month of … at the location of …”

Amru replies:

“I accept.”

Is the Salam Contract Practised Today?

Yes — in some modern contexts, the Salam contract is practised, especially when purchasing items via online platforms, where the item is yet to be delivered.

Modern Context of Salam

In many online transactions today:

- The seller may not yet own or possess the item at the time of sale.

- Traditionally, this would be prohibited, as one may only sell what one already owns.

- However, in Salam, there is a concession:

- You are allowed to place an order and make full payment upfront

- In exchange for delivery of the item at a later agreed-upon time

But what if payment is not made in full?

- In many modern cases, buyers only pay a portion (or nothing) at the time of the order, while the item is delivered a week or so later.

- This is not a valid Salam contract.

- If payment is not in full at the time of the agreement, then no valid contract (‘aqd) has taken place.

- It becomes a different kind of contract altogether.

Another Example: Placing Orders with Tailors Before Eid – An Istisna‘ Contract

During the Eid season, it is common for people to order custom-made clothes from tailors about a month in advance. Typically, they pay a deposit or half of the price upfront, and settle the remaining balance upon delivery.

This is an example of an Istisna contract, where one party commissions another to produce or manufacture a specific item.

Difference Between Istisna‘ and Salam Contracts

- In a Salam contract, the full payment must be made at the time of agreement.

- If full payment is not made, the contract is not valid.

- Salam is suitable for clearly specified goods, even if they are not yet available.

- Istisna‘, on the other hand, is used when the item needs to be custom-made or developed first.

- Payment can be made in stages or instalments.

- The contract is valid without full upfront payment.

Another example of Istisna‘ is in real estate development. A developer may not have enough capital to build homes, so they enter into Istisna‘ contracts with buyers, who make staged payments to fund the construction.

Note on Future Contracts, Derivatives, and Similar Instruments

- Derivatives such as futures, warrants, and CFDs (Contracts for Difference) are not Shariah-compliant, because:

- They involve no absolute or real ownership (fictitious assets).

- They contain elements of gharar (uncertainty) and speculation.

- The item being sold often does not exist at the time the contract is signed.

- However, there is a rare exception:

- In Malaysia, crude palm oil (CPO) futures are allowed because:

- The commodity is owned and physically present.

- The crops are real and ready to produce the commodity.

- Transactions are conducted in a highly regulated system.

- Palm oil is a strategic national commodity.

- In Malaysia, crude palm oil (CPO) futures are allowed because:

Trading Stocks

- Buying and selling stocks is permissible in Shariah, provided that:

- The trades are genuine, not fictitious.

- They are carried out through regulated markets and clearing systems.

Although there may be a delay in settlement (T+2 or T+1), this is tolerated based on ‘urf tijaarii (prevailing market practice).

What About Forex Trading?

- Retail forex trading platforms are not Shariah-compliant because:

- They do not involve real currency exchanges.

- Money is traded for cash (ribawi items), and Shariah (According to Shafi’i Madzhab) requires the following conditions:

- The transaction must take place in the same sitting (majlis).

- It must be done hand-to-hand (yadan bi-yad).

- It must be done in equal amounts (sawa’an bi-sawa’in).

- Most retail forex platforms do not meet these requirements and are therefore impermissible.

That said, institutional currency exchanges can be Shariah-compliant because:

- They involve real, tangible currency trades.

- They follow recognised industry practices.

- The T+1 or T+2 settlement periods are allowed due to customary practice.

Some individuals and Asatidz may turn to forex trading as a way to earn money, but the platform and contract structure must meet Shariah requirements. If trades are conducted genuinely, transparently, and through regulated systems (such as institutional exchanges), then they may be permissible. However, retail forex trading with leverage and no absolute ownership is not allowed under Shariah.

Question. Selling Something We Don’t Own – Can Drop Shipping Be Considered a Form of Bai‘ Salam?

Answer:

In classical Islamic commercial law, selling something that one does not yet own is generally prohibited, as it involves gharar (uncertainty) and contravenes the principle of ownership at the time of sale.

However, in modern commerce, particularly with drop shipping models, the seller accepts an order before owning the product. The seller then purchases the item from a supplier after receiving payment from the customer, and the supplier ships the item directly to the buyer.

This model raises the question: Can drop shipping be considered a valid form of Bai‘ Salam?

Key Considerations:

As we know, Bai’ Salam is a contract that involves an advance payment for a specified item to be delivered at a future date, with full payment required at the time the contract is entered into.

The similarity to Drop shipping:

Drop shipping may resemble Bai‘ Salam if certain conditions are met, such as:

- The buyer makes full payment upfront.

- The item is specified in full detail.

- Delivery is deferred to a later, agreed-upon date.

Shariah Compliance Requirements:

- The seller must take on the responsibility and risk of delivery (i.e., cannot shift all liability to the supplier).

- The transaction must avoid fictitious sales, ambiguity, and risk-free profit without ownership or liability.

- Ideally, the seller should have constructive possession or control over the item (even if not physical).

While drop shipping is not automatically equivalent to Bai‘ Salam, it can potentially fall under a Salam-based structure and be permissible if the sale is conducted with:

- Full upfront payment,

- Clearly defined goods,

- Specified delivery terms, and

- The seller bears responsibility for fulfilment.

Question: Are we supposed to be able to trade money for money? For example, if there is an opportunity to do so, is it permitted to exchange money for money?

Answer:

Yes, it is allowed. The intention to take profit from such a trade is permissible, as long as the trade legitimately takes place. This applies even when trading between different currencies. For instance, we can exchange gold for silver, making this type of trade acceptable because gold tends to appreciate in value.

The best kind of trade is when we develop something from nothing or add value to an existing thing. This way, people can benefit from it.

We cannot simply declare something permissible as impermissible. Not all uncertainty (gharar) in transactions is forbidden in Islam. Some level of gharar is tolerated, especially when it is insignificant and unavoidable in certain transactions. However, excessive gharar that can cause harm or loss to one party is prohibited.

Rahn (رهن)

Linguistically, Rahn means consistency, permanence, and certainty.

In Islamic Jurisprudence, Rahn refers to designating a valuable physical asset as collateral for a debt, from which the debt is paid in case of default.

Illustration:

For example, a person gives money as security to reassure the lender that the debt will be repaid. If the borrower defaults, the lender can use the collateral to cover the debt.

Another illustration of the Rahn Contract:

Ahmed borrowed $5,000 from his friend Bilal. To secure the loan, Ahmed pledged his motorcycle as collateral. Ahmed says to Bilal, “I pledge my motorcycle to you as security for the $5,000 I owe you.” Bilal replies, “I accept.”

In this case:

- Ahmed is the pledgor (debtor), who gives the motorcycle as collateral.

- Bilal is the pledgee (creditor), who holds the bike as security for the loan.

- The bike is the collateral that Bilal can sell if Ahmed fails to repay the $5,000.

- The debt ($5,000) is secured by the bike.

If Ahmed repays the loan on time, the bike is returned to him. If not, Bilal has the right to sell the bike to recover the money.

Constituents of the Pledge

1.Property/Collateral: This is the actual asset or item that the pledgor offers to the pledgee as security. The collateral can be anything of value, such as a house, a car, gold, or even money in a bank account. Its primary purpose is to guarantee the repayment of a debt. If the debtor fails to repay the debt, the creditor has the right to sell or retain this asset to recover the owed money.

2. Money pledged (Debt): This refers to the specific debt or obligation that is secured by the collateral. In other words, the pledged property is given to guarantee this particular amount of money owed. The debt must be clear and agreed upon by both parties, including the amount and terms of repayment.

3. Contractual Parties:

- Pledgor: This is the person who owns the property and offers it as collateral to secure a debt. Typically, this refers to the debtor—the individual who owes money. The pledgor temporarily gives control of the asset to the pledgee as a form of security.

- Pledgee: The person who receives the collateral. Typically, this refers to the creditor—the party that lent the money or is owed the debt. The pledgee holds the collateral until the debt is fully repaid.

4. Specific Pledge Procedure: This means there must be a clear and agreed-upon method or process for making, recording, and possibly handling the collateral if the debt is not paid. This includes verbal or written agreement, delivery of the collateral, and an understanding of both parties’ rights and obligations.

Conditions for the Property Pledged

1.It must be a tangible asset[2]:

This means the asset should be a real, existing thing. However, “tangible” here doesn’t just mean something physical you can touch. In Islamic finance, the term “ainan” refers to something that exists and is currently available. This contrasts with “dayn,” which means a debt or obligation that does notexist physically now but will be paid in the future.

2. It must be tradable:

The asset should be something that can be sold or transferred to someone else. This ensures that if the debtor defaults, the creditor can sell the pledged asset to recover the owed money.

Modern Example:

Nowadays, you can even pledge the money in your bank account as collateral. For example, if you have $10,000 in your account, you can pledge this amount to a creditor. If you fail to repay your debt, the creditor has the right to liquidate (withdraw or transfer) the pledged amount under agreed conditions.

Conditions for the Money Pledged

1.It must be a debt:

The money pledged must be a debt (dayn), which is the opposite of a debt (ainan), meaning something that exists now. Therefore, the pledged amount must represent a binding obligation to pay.

2. Known to both parties:

The debt must be clearly understood by both contractual parties, including the exact amount and a detailed description (e.g., SGD 30 or 1 kg of rice). Both sides must be fully aware and agree on what is being pledged.

3. Wa Kaunuhu Tsabitan (Established Debt)[3]:

The debt must be established and clear now; it should be an existing obligation.

4. Debt that is due or soon to be due:

The debt must either be payable immediately or soon payable on its own. For example, in the case of ju‘alah (a wage or reward paid upon completing a task), the pledge is only valid after the task is completed because the debt (the reward) only exists once the work is done.

Illustration of Ju‘alah:

Someone offers a reward of $1,000 for finding a lost wallet. The contract is completed only when the job (finding the wallet) is done successfully.

Conditions for the Pledgor and the Pledgee

- Free choice: Both parties must enter the contract voluntarily and with free will.

- Legally fit to gift or pledge: Individuals under duress are not permitted to pledge or receive pledges. Guardians cannot pledge or receive promises on behalf of someone under guardianship (e.g., minors or interdicted persons), except in emergencies.

Itlaquttasharruf

The ability to fully manage and dispose of one’s property.

Ahliyyatul Muamalah

The capacity to perform legal transactions.

Requirements for someone to have capacity for voluntary transactions (Ahliyyatu Tabarru’):

- Bulugh (Maturity): The person must be an adult.

- Aaqil (Sound mind): The person must be mentally competent.

- Hurriyah (Freedom): The person must be free (not enslaved).

- Milk (Ownership): The person must fully own the item/property.

- Wilayah (Authority): The person must have the authority or legal capacity over the asset.

Transfer of Item

The transfer of the pledged item can be done unilaterally through a voluntary contract (akad).

Conditions for Pledge Procedure

These are the same as the Conditions for Trade Procedure, which include 13 conditions (not listed here but generally include clarity, consent, capacity, lawful object, etc.).

Illustration of Pledge Contractual Procedure

Amru owes Zaid 1000 dinars, and the debt is due. Amru says to Zaid, “I pledge my house to you for the 1000 dinars I owe you.” Zaid replies, “I accept.”

Question: Owning an Item and Pawnbroking

Answer:

Sometimes, when we need money, we sell our item to a buyer, but the buyer allows us a certain period to repurchase the asset for a specific amount. Why do people want to do this? Because they need the money. However, this is not considered a Rahn (pledge) contract.

What is not allowed is conventional pawnbroking. In traditional pawnbroking, you give your gold (or other valuable item) as a pledge in exchange for a loan, which you will repay later. This type of loan arrangement includes riba (interest), specifically riba jahiliyyah (pre-Islamic usury), which is forbidden in Islam.

Nowadays, there are Shariah-compliant pawn broking businesses—for example, in Singapore—where the system is designed to avoid interest and comply with Islamic principles. Such systems used to exist in Malaysia but are no longer practised there due to controversies and elements that make the practice problematic. Many scholars in Malaysia also disagree with this type of pawnbroking.

Question: We discussed pawnbroking and conventional home mortgages. In some cases, people consider them as darurah (emergency necessity) to justify their use, but actually, they do not meet the strict criteria of darurah in Islamic law.

Answer:

For example, if I want to lend you one million (currency), this should be done without involving prohibited elements like riba (interest). The presence of interest renders the transaction impermissible, even if one claims it is necessary.

In Islam, darurah allows exceptions only in cases of genuine emergencies where no lawful alternatives exist, and even then, only the minimum required to alleviate the harm is permitted. Conventional mortgages or pawnbroking with interest usually do not fall under this category because alternative, permissible financial solutions are available.

[1] Al-Qur’an, Surah Al-Baqarah (2:282).

[2] It can be argued that modern-day equities do not fit this criteria and rightfully so as the stocks face foreseeable uncertainties that are not faced by valuable commodities like cars and government houses (in the case of Singapore). Although both face depreciation, both still can be traded even at depreciated prices; however the stock equities in some periods will face non-tradability issues and lead to falling stock prices in the secondary market. There are issues with stocks as there are times where it cannot be sold unlike cars and houses which can be sold at relatively lower prices.

[3] The idea here is that there might still be disputes as to whether the debt was cleared in the first place; if it was cleared there is no debt; this has to be clear from the very beginning

https://islamicfinance.sg/summary-class-5/