Why Halal (Shariah-Compliant) Stock Investing Matters

With rising inflation and the growing cost of living, investing is no longer optional. It is becoming essential for anyone who wants to keep pace with economic realities. Stocks are often the backbone of a strong portfolio because they offer accessibility, long-term growth potential, and liquidity.

Halal investing, however, provides something more. Beyond meeting religious requirements, Shariah-compliant investing promotes ethical behaviour, responsible financial conduct, and participation in real economic activities. When done right, it aligns both your financial goals and your values.

If you are new to this space, do not worry. This article will guide you through the fundamentals of Shariah-compliant stock investing and show you beginner-friendly tools to start your journey with confidence.

Shariah-Compliant Stocks: Understanding the Foundation

Shariah-compliant stocks are shares of companies that satisfy the rules and principles of Islamic finance. Some companies are fully halal by nature, while others fall into a mixed category because their business includes both permissible and non-permissible elements.

To address this complexity, Shariah scholars developed a structured screening process to assess companies. Mixed companies can still be considered halal as long as prohibited elements fall within accepted thresholds.

The first formal screening effort took place in 1983 by Bank Islam Malaysia Berhad, followed by the global standardisation work of AAOIFI in 1991. Since then, screening frameworks have gone through multiple revisions to keep pace with increasingly complex global markets. Today, these methodologies help ensure that portfolios remain compliant, relevant, and ethically grounded.

Determining Halal Stocks: What Every Muslim Investor Should Know

Determining whether a stock is halal involves two main stages: qualitative screening and quantitative screening.

1. Business Activities (Qualitative Screening)

This stage examines what the company actually does. Activities that are clearly non-compliant include:

-

Liquor and related industries

-

Pork and pork-based products

-

Tobacco

-

Non-halal food and beverages

-

Gambling

-

Conventional banking and insurance

-

Weapons, defence, and other harmful industries

-

Entertainment businesses deemed non-permissible

If a company’s core activity involves any of these, it is excluded.

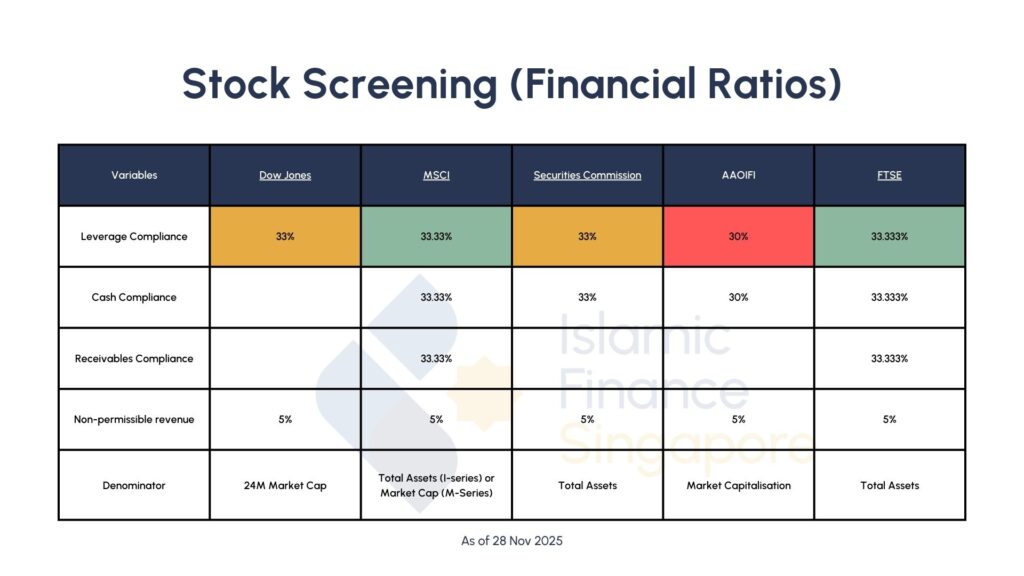

2. Financial Ratios (Quantitative Screening)

Qualifying companies must also meet specific benchmarks related to:

-

Debt

-

Liquidity

-

Interest-based income

-

Non-compliant revenue thresholds

These ratios ensure that any exposure to non-halal elements stays within Shariah-defined limits. Different organisations and scholars may apply slightly different thresholds, but the objective remains the same: ensuring minimal involvement in prohibited activities.

To dive deeper into how Shariah-compliant stock screening works, you can explore our full step-by-step guide here: https://islamicfinance.sg/shariah-compliant-stock-investment-guide/

Beginner Method: Screen First, Analyse Second

To begin your halal investing journey, use this simple, beginner-friendly workflow:

-

Step One: Screen the stock for Shariah compliance

Use a platform dedicated to Islamic screening such as RizqX. -

Step Two: Analyse the company’s fundamentals

Once a stock is confirmed halal, use an analysis tool such as TYKR or Sterling Stock Picker to assess financial strength, valuation, and long-term potential.

This two-step method ensures every investment is both halal and financially sound.

Step One: Use RizqX as Your Primary Shariah Stock Screener

RizqX is your first and most essential stop in the halal investing process. The platform screens more than 27,000 global stocks for Shariah compliance, giving Muslim investors a clear and accessible way to determine which companies align with Islamic principles.

But RizqX is far more than a simple filter. It is designed as an all-in-one halal investing ecosystem, one that supports screening, learning, evaluating, and purifying your investments, allowing you to make confident and faith-aligned decisions from the very beginning.

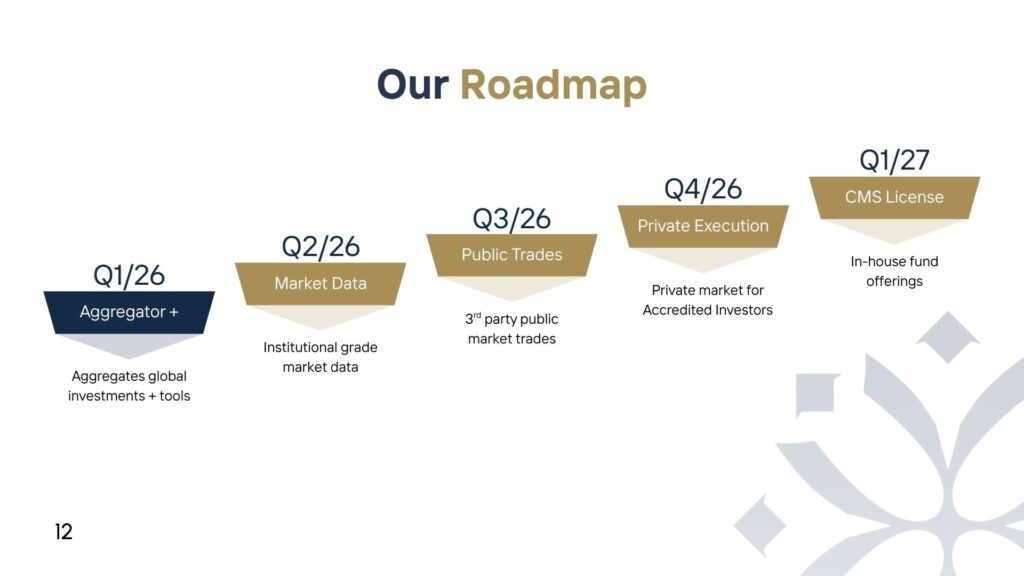

RizqX is still in its early growth phase, yet it already offers a powerful suite of tools that make it one of the most practical and meaningful entry points for Muslims just getting started. Here is its roadmap:

What Makes RizqX Different?

While most screeners provide only a pass-or-fail label, RizqX offers a comprehensive ecosystem built around the needs of Muslim investors.

- Global Coverage of 27,000+ Stocks and growing

- RizqX allows Southeast Asia’s 240 million Muslims to access halal public and private investment opportunities that are typically scattered and underpublicised. These opportunities span diverse sectors and can offer returns ranging from around 5 percent to well above 40 percent depending on the asset class.

- Dividend Purification Made Simple

- Since many companies earn a small portion of income from non-permissible sources, RizqX automatically calculates the necessary purification amount. This ensures your portfolio’s returns remain halal and spiritually sound.

- Built-in Zakat Calculation

- Zakat on stocks can be confusing for many investors. RizqX removes the guesswork with automated zakat estimations based on your holdings, helping you fulfil this essential obligation with ease and accuracy.

- Muamalat Essentials Class Access

- Users receive access to exclusive classes on Islamic commercial principles. This ensures investors not only invest correctly, but also understand the why behind the rulings.

- Monthly Portfolio Consultations

- Early adopters receive 30 minutes of monthly consultation time to discuss portfolios, ask questions, and receive guidance from the RizqX team.

- Early Access to Purifai (Zakat 2.0)

- RizqX users gain early access to Purifai, a next-generation zakat automation platform designed to calculate zakat across multiple asset classes including crypto, ETFs, private equity, and real estate.

- Exclusive Event Discounts

- Early users receive special discounts to IslamicFinanceSG and RizqX events including symposiums, masterclasses, and investor meetups helping them stay connected and continuously learning.

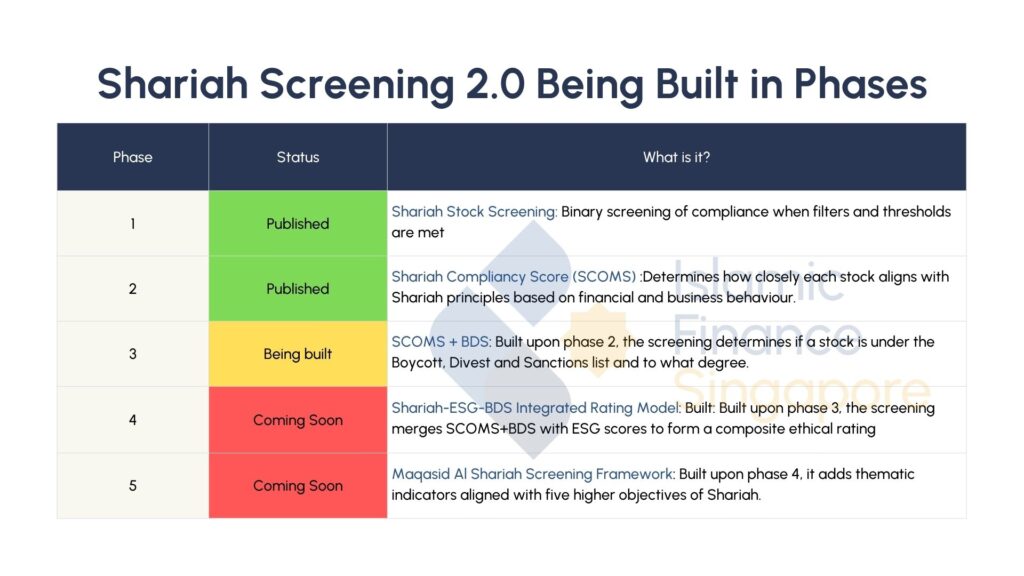

Going Beyond Simple Halal or Haram Labels

Most stock screeners provide a binary outcome: halal or non-halal. While useful, this approach lacks nuance. Two stocks may both be halal but differ significantly in how closely they align with Islamic values.

To solve this, RizqX introduced the Halalness Score.

The Halalness Score

The Halalness Score offers a graded and detailed evaluation of how closely a stock aligns with Islamic principles. Instead of a simple yes or no, investors get a clearer picture of the company’s ethical standing and can make more informed, values-driven decisions.

Through this roadmap, RizqX is not only meeting practical investing needs but also restoring meaning, intention, and holistic ethics to how Muslims grow and purify their wealth.

Early Adopter Offer (Limited Time)

RizqX is opening its doors to Early Adopters at a special rate of S$50 per year (usual price S$100). This offer grants full access to current tools and upcoming features while giving early supporters the chance to be part of Islamic financial innovation in Southeast Asia.

Become an early adopter here and take advantage of the pricing today before it goes up!

Final Thoughts on RizqX

RizqX stands out as a platform that blends technical rigour with deep Islamic values. Its tools are clean, beginner-friendly, accessible pricing, and its roadmap reflects a long-term commitment to serving the Muslim investing community. For those seeking a principled, comprehensive, and structured way to begin halal investing, RizqX is the ideal first step.

Step Two: Use TYKR or Sterling Stock Picker to Analyse Your Shortlisted Halal Stocks

Once you have identified halal stocks through RizqX, the next step is to determine whether those stocks are financially strong, fairly valued, and suitable for your long-term goals. This is where tools like TYKR and Sterling Stock Picker come in. They do not screen for Shariah compliance that part is already handled by RizqX but they help you analyse, evaluate, and understand the financial merit of the companies you are considering.

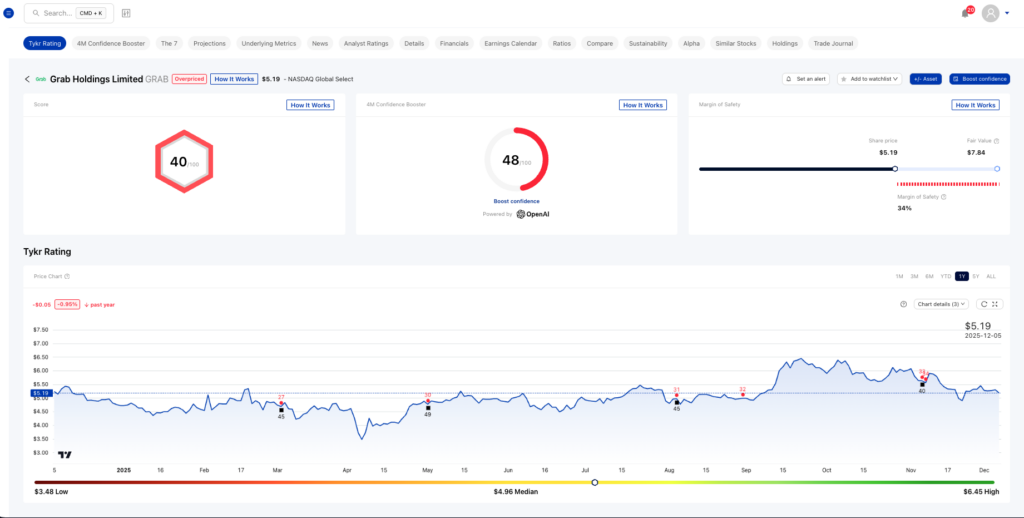

TYKR: A Beginner-Friendly Platform for Value-Based Stock Analysis

TYKR embodies the principles of Warren Buffett-style value investing, where discipline, patience, and data-driven thinking form the foundation for long-term success. The platform guides investors toward smart, long-term decisions by simplifying financial analysis and presenting it in a way that even total beginners can understand.

TYKR’s growth reflects its impact. Starting with just one paying user in its first six months, it has since expanded to more than 12,000 users across 50 countries by 2025, supported by an impressive 4.7 out of 5 Trustpilot rating a testament to its accessibility and user satisfaction.

Budget-Friendly Cost

TYKR offers three structured plans designed for different levels of investors:

Premium Plan — SGD 10.42 per month

This plan gives full access to both the web and mobile apps, allowing you to analyse over 40,000 stocks, 1,500 ETFs, and crypto assets. You also receive step-by-step guidance on buy and sell decisions, the ability to create up to 20 portfolios, and alerts for price changes, key events, and score updates.

Premium Plus — SGD 37.50 per month

For investors wanting enhanced capability, this tier expands your portfolio capacity and allows connection to up to three brokerage accounts. You can also follow stock suggestions from TYKR’s founder, Sean Tepper, and participate in a growing community of investors.

Advanced Plan — SGD 94.50 per month

Designed for serious investors or those managing multiple portfolios, this plan supports 500 watchlists and portfolios, advanced analytics, up to 15 brokerage connections, and the ability to download data for offline analysis. Weekly trade ideas from Sean Tepper are also included.

All plans come with a generous 14-day free trial, with no credit card required — making it easy for users to explore the platform without commitment.

TYKR’s Unique Stock Rating System

One of TYKR’s standout features is its beginner-friendly rating system, designed to simplify complex financial reports into clear, actionable insights.

Stocks are classified into three straightforward categories:

-

“On Sale” — financially strong and undervalued

-

“Watch” — neutral factors to monitor

-

“Overpriced” — financially weak or overvalued at current prices

Only around 15 percent of stocks earn the “On Sale” rating, making it a helpful and conservative filter for value-focused investors.

Each stock is also assigned a 0 to 100 score, providing an at-a-glance measure of financial strength. Higher scores indicate stronger business fundamentals, growth potential, and sound financial management. Lower scores point to weaknesses or potential risks to consider.

This intuitive system makes TYKR a particularly strong companion for beginners who want clarity without navigating dense financial reports.

Our Take on TYKR

TYKR stands out as one of the most beginner-friendly tools for fundamental analysis. Paired with RizqX which ensures Shariah compliance, TYKR helps Muslim investors looking for financially strong companies that are not only halal but also worth investing in from a value perspective.

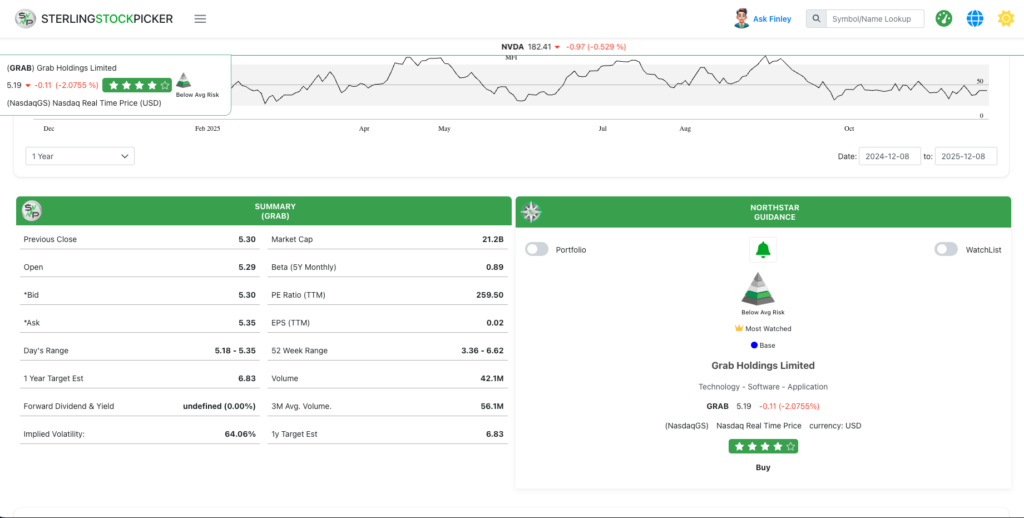

Sterling Stock Picker: AI-Assisted Investing for Values-Driven Investors

Sterling Stock Picker is an all-in-one stock analysis and portfolio management platform ideal for beginners and intermediate investors who want guided, values-based investing. The platform blends professional-grade financial intelligence with user-friendly AI assistance, ensuring even inexperienced investors can navigate the stock market without feeling overwhelmed.

Its promise is simple: “You don’t need to be an expert to invest like one.”

Alongside monthly and annual subscription options, making it appealing for budget-conscious investors seeking long-term access.

Meet Finley: Your Personal AI Finance Coach

One of Sterling’s most distinctive features is Finley, an AI assistant that provides personalised guidance based on your preferences and risk profile. Finley can:

-

Suggest stocks tailored to your investment goals

-

Explain investment concepts in simple language

-

Analyse companies in real time

-

Help you understand risks, growth potential, and suitability

This makes Sterling not just a research platform but a companion helping you learn and grow as an investor.

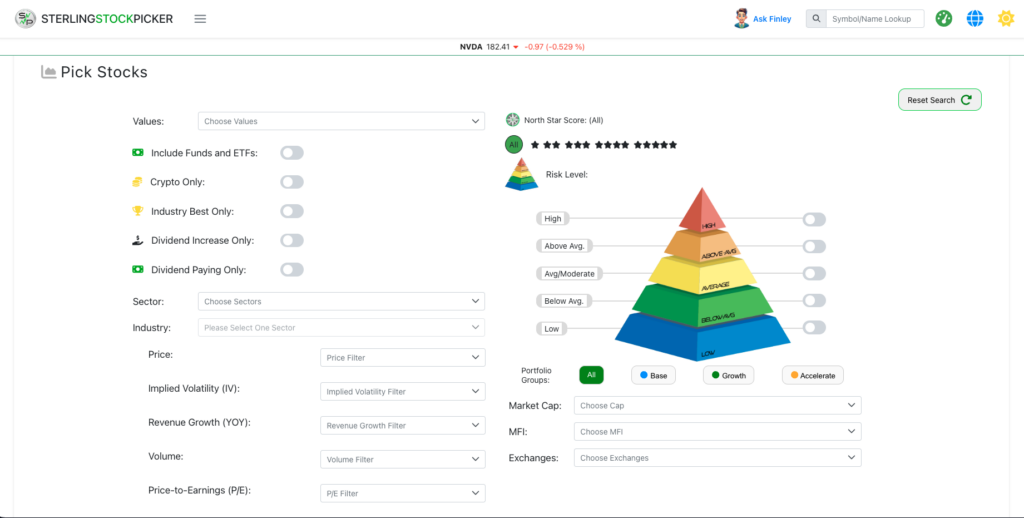

Search for Stocks That Matter to You

Sterling enables highly personalised filtering through its Pick Stocks tool. Instead of browsing thousands of companies, you can filter based on:

-

Industry

-

Risk level

-

Dividends

-

Growth potential

-

Ethical and personal values

This allows you to shortlist stocks that reflect both your long-term goals and your personal convictions, an especially useful feature for Muslim investors who must consider both financial and values-based criteria after confirming Shariah compliance through RizqX.

Guided Portfolio Builder and Risk Assessment

Sterling also includes a structured Portfolio Builder that starts with a 13-question risk assessment. Based on your answers, it categorises you into profiles such as:

-

Low Risk

-

Moderate Risk

-

High Risk

The platform then recommends suitable stocks aligned with your risk appetite.

The Portfolio Assistant analyses your selections and suggests rebalancing strategies. It categorises stocks across four areas:

-

Base

-

Overview

-

Growth

-

Accelerate

Each stock comes with a risk indicator to ensure you remain aligned with your comfort level and long-term strategy.

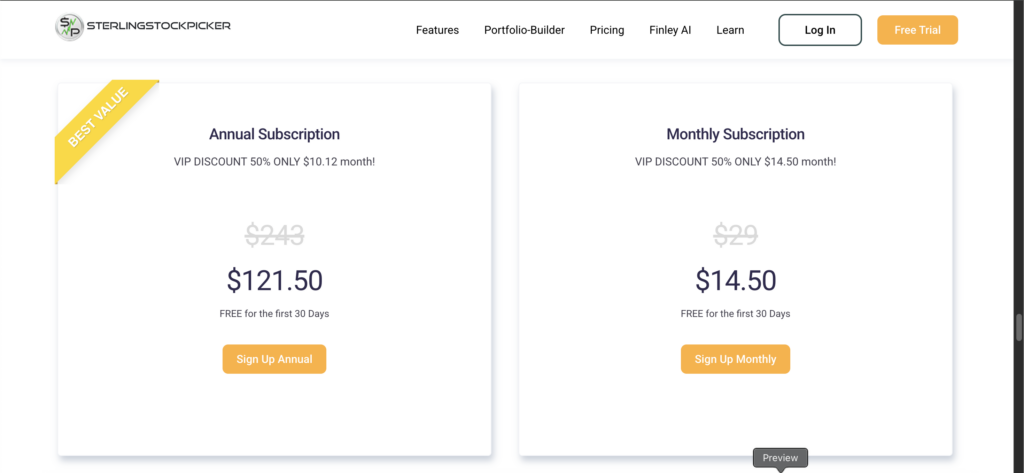

How Much Does Sterling Stock Picker Cost?

Sterling offers several pricing options to match investors at different stages:

-

Monthly Plan: USD 29 per month with a 30-day free trial

-

Annual Plan: USD 243 per year (equivalent to USD 20.25 monthly), also with a 30-day free trial

There’s also Lifetime Plan (AppSumo) priced at USD 69 one-time payment, providing lifetime access to core features without recurring fees. While attractive, this offer is available at Appsumo for an unknown time period. The lifetime deal may especially attractive for new investors who want access to premium tools without long-term subscription commitments.

Our Take on Sterling Stock Picker

Sterling Stock Picker excels in making investing approachable, personalised, and educational. When paired with RizqX for Shariah screening, it becomes a powerful tool for Muslim investors who want both values-aligned and data-driven decision-making.

Whether you are building your first halal portfolio or refining an existing strategy, Sterling offers practical tools, helpful AI support, and strong long-term value.

You’re Serious About Investing: Here’s How to Begin

1. Open a Brokerage Account

A brokerage account is your gateway to buying and selling stocks. When choosing one, consider:

-

Fees

-

Available markets

-

User experience

-

Fractional investing

A step-by-step guide for setting up a brokerage account is available here:

- Interactive Brokers (More market access despite the more complex UI and does allow for certain fractional investing) : https://islamicfinance.sg/ibkr/

- CGSI (More market access and end-to-end Shariah Compliant brokerage execution, but legacy UI: https://islamicfinance.sg/shariah-compliant-stock-investment-guide/

- Tiger Brokers (Mobile-friendly app that is more user-friendly despite its powerful functions, which allows for certain fractional investing): https://islamicfinance.sg/easy-steps-to-start-investing-in-shariah-compliant-etfs-ifsg/

- Webull and Syfe: We don’t have articles on Webull or Syfe yet, but both apps are user-friendly, with clean interfaces and support fractional investing, making them perfect for beginners.

2. Start Small and Diversify

Begin with smaller investments and build gradually. Diversify across industries and regions while staying within Shariah boundaries to reduce risk and improve long-term stability.

Final Thoughts

And there you have it, beginner-friendly, structured, and practical methods to start your Shariah-compliant investing journey. With advancements in Islamic fintech and AI-driven tools, Muslims now have fewer barriers and more opportunities to invest responsibly.

While halal investing requires some additional diligence, tools like RizqX, TYKR, and Sterling Stock Picker make the process not only accessible but empowering. Whether you are just getting started or refining your investment strategy, these platforms can help you make informed, ethical, and financially sound decisions.

Take advantage of RizqX’s early adopter offer here!

[1] View of A Comparative Analysis of Shariah Stock Screening Methodology for Securities Commission Malaysia and Major International Shariah Index Providers. (2025). Iium.edu.my. https://journals.iium.edu.my/jiasia/index.php/jia/article/view/1213/607